Michael Saylor, the executive chairman of Strategy (formerly MicroStrategy), is making headlines once again with…

30% of Women Pick Bitcoin First as Crypto Investment Surges Worldwide

- Women prefer Bitcoin and Ether, prioritizing financial growth over quick profits.

- Education and financial constraints remain barriers for female crypto investors.

- More women are entering leadership roles in blockchain and crypto security.

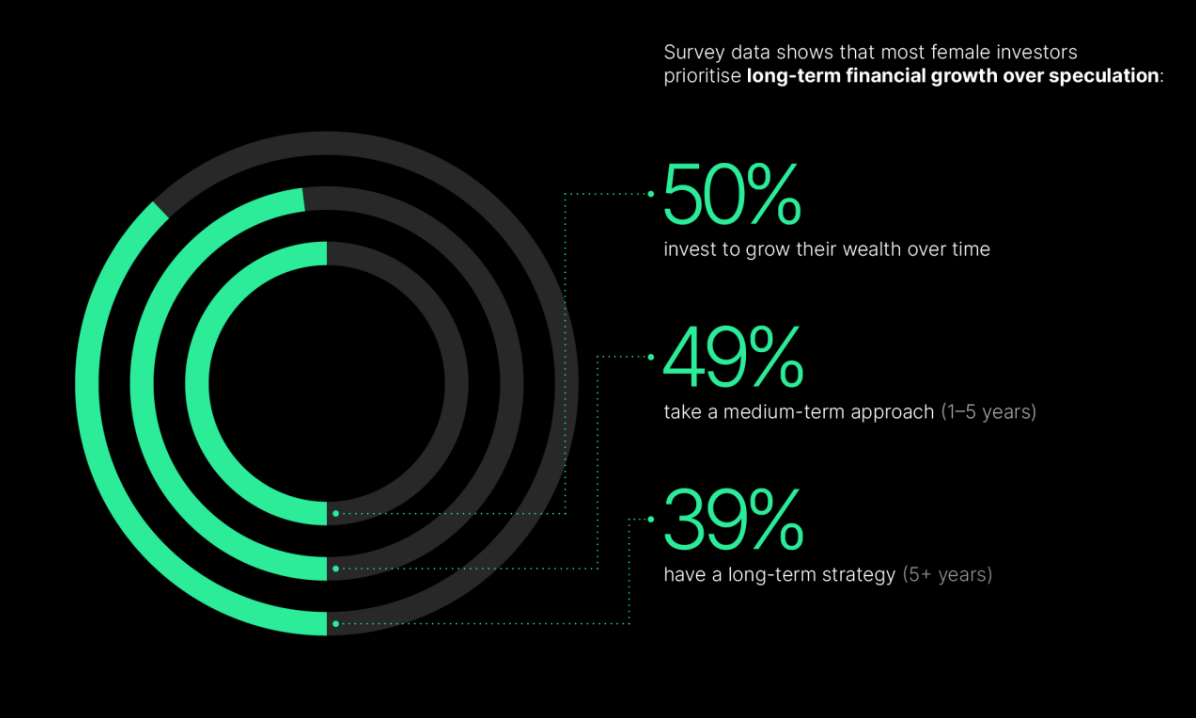

Women are making significant strides in cryptocurrency investment, prioritizing long-term financial growth and stable assets like Bitcoin. A recent survey by Bitpanda found that 50% of female investors focus on long-term wealth accumulation, with 49% holding digital holdings for up to five years and 39% planning to hold for more than five years. Unlike men, who trade more frequently, women adopt a patient and strategic investment style.

However, despite increasing participation, 81% of female investors still consider themselves inexperienced, with financial constraints posing additional barriers.

Women Prioritize Stability Over Short-Term Gains

Female investors gravitate toward well-established cryptocurrencies, with Bitcoin being the most popular choice. According to the survey, 30% of women chose Bitcoin as their first investment, compared to 24% of men. 54% of female investors focus on widely recognized digital assets such as Bitcoin, Ether, and XRP.

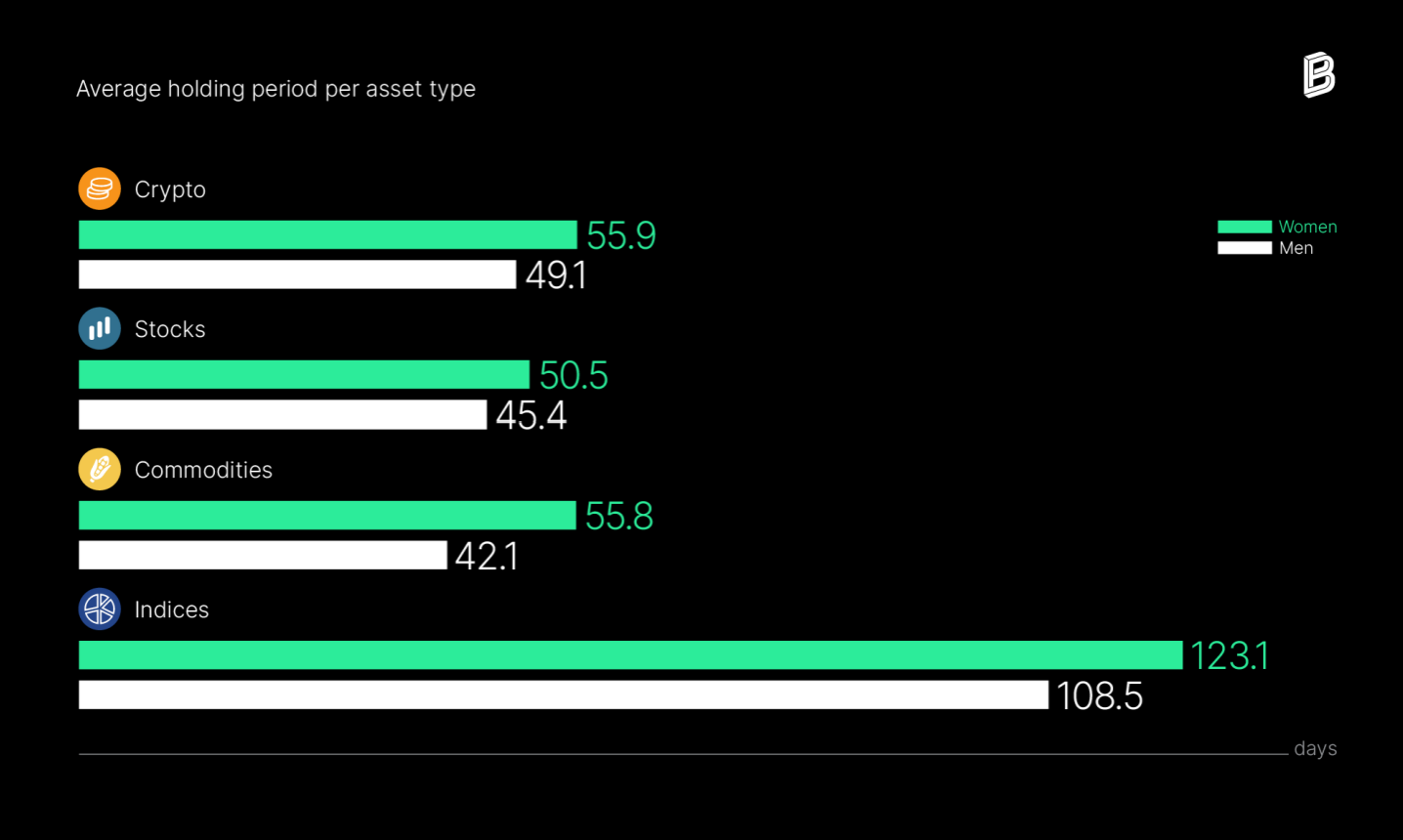

Women tend to build diverse portfolios and prefer stability over short-term speculation. Gracy Chen, CEO of Bitget on X, noted that women trade less frequently than men, making them less susceptible to emotional market reactions. Studies show that men execute 13 trades annually on average, but women make only nine. Nkiru Uwaje, co-founder of Mansa, explained that women often view Bitcoin as a broader wealth-building strategy rather than an isolated investment.

Challenges in Education and Financial Accessibility

Despite growing interest, many women face obstacles when entering the crypto market. A lack of investment knowledge remains a significant challenge, with 24% of female investors citing it as their primary barrier. Additionally, 41% reported financial constraints as a limiting factor.

Even with these hurdles, female participation in cryptocurrency investment is rising. Bitpanda’s data shows that women who started investing in January 2024 saw their portfolios grow by an average of 8.1% over the past year. A separate study by Mudrex found that female crypto investors increased tenfold in 2024-2025, with the majority aged 25-35.

Women’s Expanding Role in Crypto and Security

Beyond investing, women in Ethereum are gaining prominence in the crypto industry, particularly in security and blockchain leadership roles. Erin Fracolli at Binance leads investigations into financial crimes, while Trust Wallet’s Eve Lam encourages women to join cybersecurity by proving their skills through open-source contributions.

As more women enter the crypto space, addressing educational gaps and financial accessibility will be crucial for fostering long-term inclusion and success in the industry.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.