- Polygon’s growth slowed as real user adoption never gained traction.

- Competing Layer 2 networks drew users away from the Polygon ecosystem.

Polygon once promised to solve Ethereum’s scalability problems. Polygon began in 2017 with a mission to scale Ethereum. The project raised $450 million through an initial coin offering (ICO). Its founders aimed to make Ethereum transactions faster and cheaper for everyone. That promise positioned Polygon as a key Layer 2 contender.

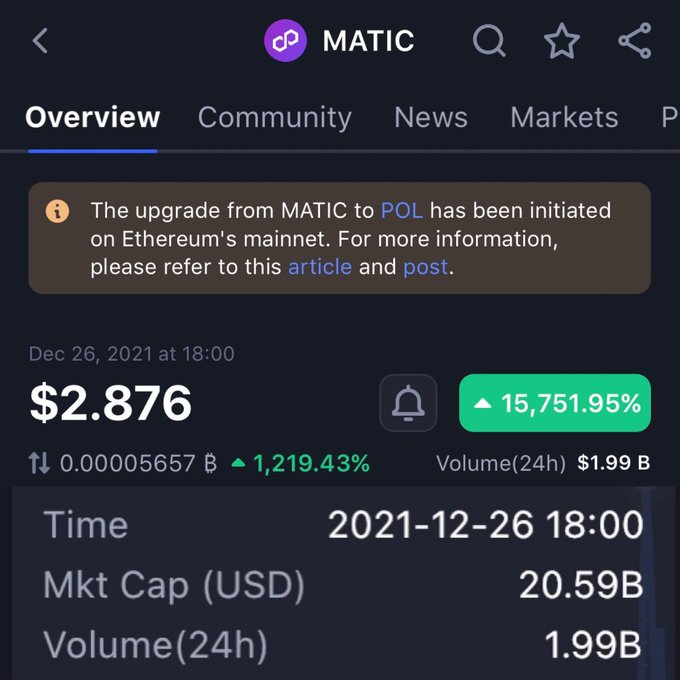

By 2021, excitement had reached its peak. MATIC, Polygon’s native token, climbed to $2.68. Investors, fueled by optimism, drove the market cap past $20 billion.

However, beneath the hype, real adoption remained limited. Analysts noted a lack of high-traffic decentralized applications on the network.

Hype Masked Deeper Adoption Challenges

Despite impressive funding and price action, Polygon struggled to retain user interest. Data shared by Crypto Jargon suggested the ecosystem failed to attract sticky users. Many joined during bull runs but didn’t stay engaged. The excitement covered growing concerns over utility and scalability.

Critics pointed out that while the project promised low-cost and high-speed transactions, execution lagged. Some users reported inconsistent performance and limited developer traction.

Over time, competitors like Arbitrum and Optimism gained ground, drawing away users and projects. The drop in usage is reflected in the token price. MATIC has declined by 85% from its all-time high, marking a steep fall.

User Exodus and Uncertain Path Ahead

As the broader crypto market matured, Polygon’s flaws became more apparent. The user exodus continued, and developers started shifting to other scaling solutions. Telegram channels such as Savvy Strat and Crypto Jargon highlighted dwindling engagement.

Despite strong early financial backing, Polygon’s core challenge remains unresolved. Its current struggle shows the gap between raising capital and building sustainable user ecosystems. Without clear differentiation, Polygon risks being overtaken by faster-evolving platforms.

The Polygon story highlights a recurring theme in crypto: strong narratives alone cannot guarantee lasting adoption.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.