The Bitcoin options market is experiencing an unusual calm, with implied volatility (IV) across all expiries (1 week to 6 months) hitting near-record lows since mid-2023, according to a recent analysis by Glassnode.

Despite Bitcoin hovering near all-time highs of approximately $110,000, the market’s expectation of future price swings has significantly diminished, a trend echoing the traditional summer slowdown in financial markets. This disconnect between price stability and low volatility suggests a potential shift in investor behavior.

Glassnode’s data, shared on X earlier today, indicates that both spot and futures volumes have dried up, with spot volume at $5.02 billion and futures at $31.2 billion—the lowest in over a year. This aligns with historical patterns, such as the 2021 summer lull when Bitcoin’s price dropped 50% from its April peak, as noted in past market analyses. A study from Financial Innovation further supports this, classifying Bitcoin options volatility as commodity-like, with a forward skew that often precedes sharper corrections.

The current low IV could mask underlying risks. With approximately $1.2 trillion in unrealized profits (per Glassnode’s on-chain metrics), a sudden shift in sentiment—perhaps triggered by macroeconomic events or institutional moves—could spark volatility. Historical data from Investopedia highlights that prolonged low-volatility periods often precede significant corrections, as profit-taking accelerates.

Market observers on X, including analysts like Brenda Robbins, suggest this calm might be a “powder keg setup,” with a potential gamma squeeze looming as institutional activity resumes post-summer. For investors, this underscores the need for caution. Dollar-cost averaging and maintaining cash reserves could mitigate risks during an anticipated volatile rebound.

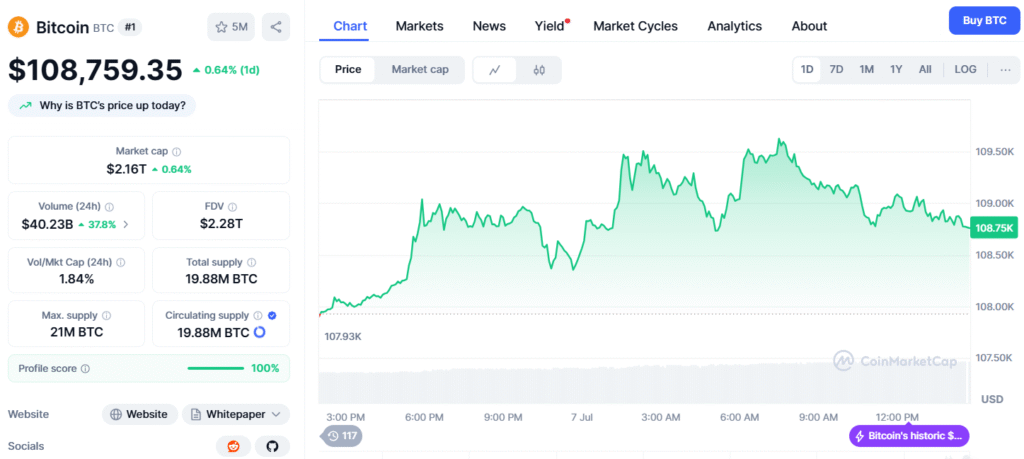

As of July 7, 2025, the current Bitcoin (BTC) price on CoinMarketCap stands at approximately $108,759 USD, reflecting a slight dip in volatility amid a summer lull.For a detailed view, check the live chart, which tracks BTC’s price movements and market trends in real-time.

The chart highlights a recent stabilization near all-time highs, with a market cap of $2.17 trillion, though declining volumes signal potential short-term risks. As Bitcoin’s market structure evolves, the coming weeks will be critical to watch, with open interest and whale flows serving as key indicators of the next move.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.