The decentralized finance (DeFi) landscape is buzzing as Uniswap, a leading automated market maker (AMM), records a historic spike in dormant activity.

According to Santiment’s latest analysis, Uniswap’s market cap has surged 21% since June 22, 2025, accompanied by a staggering 72.95 billion age-consumed metric—the highest in UNI’s history. This metric, which measures the movement of long-held tokens multiplied by their age, indicates a significant reactivation of dormant wallets, with the average holding age dropping by 7.2%.

This shift suggests that previously stagnant UNI tokens are re-entering circulation, potentially heralding increased network activity. Historically, such dormant spikes have correlated with market value boosts. A 2020 Santiment study on Sanbase Pro identified similar patterns with Bitcoin, while a 2023 Binance report noted reactivations of dormant addresses often precede price rallies. Though not a guaranteed predictor, the trend aligns with DeFi’s growth dynamics, where AMMs like Uniswap enhance liquidity and reduce trading costs—a concept validated by the 2021 Journal of Financial Economics.

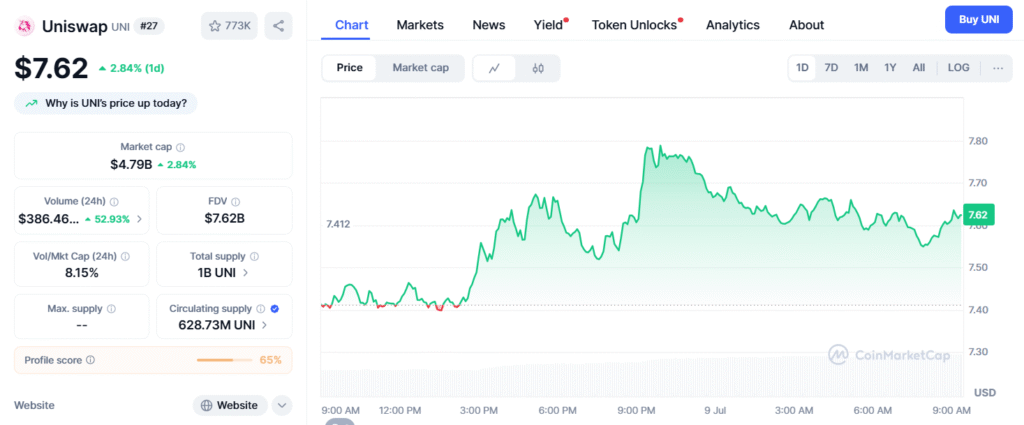

The reactivation could reflect growing investor confidence or profit-taking by long-term holders, as outlined in Glassnode Academy’s analysis of coin dormancy. With Uniswap’s current market cap at $4.61 billion (per CoinMarketCap) and a 24-hour trading volume of $249.7 million, this movement might amplify bullish sentiment. However, the crypto market remains volatile, and external factors like regulatory shifts could influence outcomes.

For real-time tracking, Santiment provides a handy chart to monitor further dormant coin movements. As the DeFi sector evolves, this spike positions Uniswap as a key player to watch.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.