- Dollar weakness historically signals strong Bitcoin bull market potential.

- ETF inflows support Bitcoin’s price despite low speculative momentum.

Bitcoin continues to hold steady above $108,000 as macroeconomic signals align with historical bullish patterns. Analysts point to a weakening U.S. Dollar Index (DXY) as a recurring indicator of Bitcoin strength. Meanwhile, institutional flows through ETFs and substantial spot premiums are supporting BTC’s price.

Dollar Weakness Mirrors Previous Bitcoin Bull Cycles

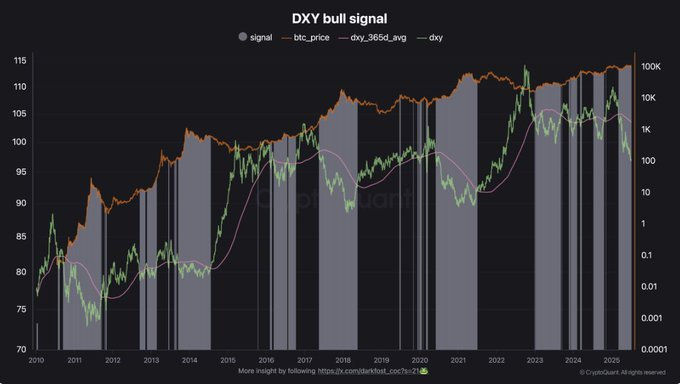

CryptoQuant’s latest analysis, shared by top analyst Darkfost, highlights a consistent inverse relationship between the U.S. Dollar Index (DXY) and Bitcoin. The data shows that when the DXY trades below its 365-day moving average, Bitcoin often enters strong uptrends. Historical examples include major rallies in 2013, 2017, and 2020.

As of mid-2025, DXY is again under its 365-day average, suggesting the conditions for another bullish phase are present. The correlation is visualized in a chart where the DXY is shown in green, its 365-day average in pink, and Bitcoin’s price in orange. This pattern supports the narrative of Bitcoin acting as a macro hedge during periods of dollar weakness.

ETF Inflows and Spot Premiums Support Price Stability

Market analyst Daan Crypto Trades reports that Bitcoin’s spot premium remains stable, with continuing institutional buying through ETFs. Bitcoin is currently trading above $108,000, while the perpetual futures basis stands slightly negative at -0.05%. This implies cautious sentiment, where real demand is outpacing leveraged speculation.

Daan noted that while ETF inflows have absorbed supply efficiently, a prolonged sideways range could risk a drawdown if momentum doesn’t return. He emphasized that a breakout remains possible once market liquidity tightens. The structure appears firm but leans on sustained demand rather than aggressive bullish speculation.

Key Price Levels and Momentum Indicators in Focus

As of July 9, 2025, Bitcoin is priced at $108,618 with a minor daily decline of 0.29%. The updated chart shows BTC consolidating between resistance at $112,040 and a new support level at $104,768.

The Relative Strength Index (RSI) sits at 55.95, with a close signal line at 55.42, suggesting mild bullish momentum. Trading volume remains low, confirming market indecision during this consolidation.

A breakout above $112,000 could open the path for further gains, while a drop below $104,768 may lead to bearish pressure. Until a clear catalyst emerges, Bitcoin is expected to continue trading within this narrow range.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.