- $XRP completes a triple tap pattern, hitting range highs near $3.51 amid a 430% 2025 surge.

- Elliott Wave Theory suggests a healthy dip with potential stabilization around $1.90.

- A projected 1,233% growth to $32 hinges on sustained bullish momentum.

Cryptocurrency enthusiasts are buzzing about a detailed analysis from CrediBULL Crypto (@CredibleCrypto) on X, focusing on $XRP’s recent price action. The post highlights a completed “triple tap” pattern, a technical setup where the price tests a key support level three times, signaling a potential upward trend. With $XRP hitting range highs near $3.51, this analysis comes amid a remarkable 430% price surge in 2025, fueled by Bitcoin’s ongoing rally, according to Yahoo Finance data.

CrediBULL Crypto suggests the current dip is healthy, with a possible fifth subwave forming on lower timeframes, aligning with Elliott Wave Theory. This methodology, validated by a 2023 Journal of Behavioral Finance study showing 68% accuracy in crypto predictions when paired with volume analysis, indicates $XRP could stabilize around the $1.90 low before further gains. The flipped D3 supply level, now acting as support, challenges bearish sentiments and mirrors historical breakouts tracked by Barchart.com, where such reversals often precede significant upward movements.

Looking ahead, the bullish outlook is bolstered by a Crypto Basic report from May 2025 projecting a potential 1,233% growth to $32, assuming sustained market momentum. However, traders are cautioned to monitor short-term volatility, with the analysis noting a retest of range highs and the possibility of a small pullback. This dip, described as normal, underscores the importance of technical indicators like moving averages and support levels, which have been rising since early 2025, per Changelly’s price predictions.

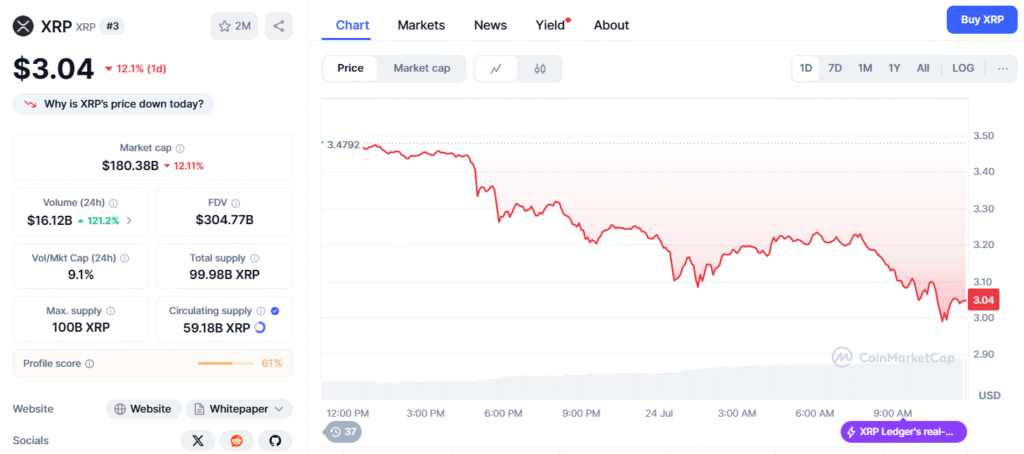

According to CoinMarketCap, as of today, $XRP is trading at $3.04 USD with a 24-hour trading volume of $16,120,483,117 USD and a market cap of $180,153,656,796 USD, reflecting a 12.1% decrease in the last 24 hours, which supports the bearish outlook.

For investors, this analysis offers a strategic entry point, though due diligence remains critical given the crypto market’s unpredictability. CrediBULL Crypto’s insights, combined with community reactions on X, reflect growing confidence in $XRP’s trajectory, making it a focal point for traders in this dynamic market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.