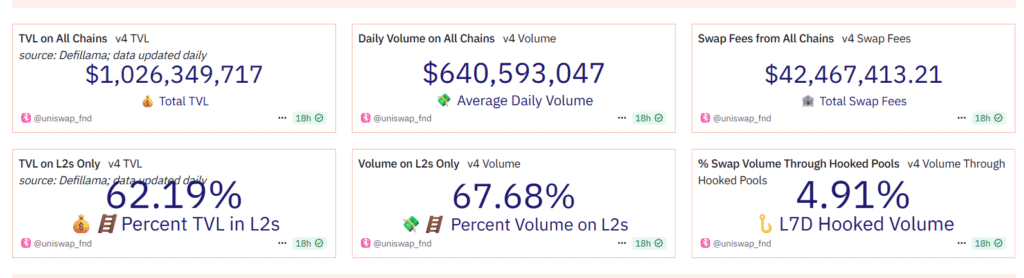

- Uniswap v4’s TVL exceeds $1 billion, with $110 billion in trading volume led by Unichain and Ethereum.

- Bunni’s $1 billion volume showcases yield-optimizing pools, outpacing EulerSwap’s muted performance.

- TVL doubled in 21 days, hinting at AI-driven growth, though fee competition poses risks.

Uniswap v4 has achieved a significant milestone, surpassing $1 billion in Total Value Locked (TVL) and accumulating over $110 billion in cumulative trading volume. This growth, primarily concentrated on Unichain and Ethereum, underscores the protocol’s dominance in decentralized finance (DeFi).

The introduction of over 2,500 custom “Hooks” has revolutionized liquidity pool management, offering unprecedented flexibility compared to earlier versions. This innovation has fueled rapid adoption, with the TVL doubling in just 21 days—a stark contrast to the 45 days it took Uniswap v3 to reach a similar mark.

Among the standout performers, Bunni has emerged as a key player, recording over $1 billion in trading volume. Bunni’s success stems from its advanced yield-maximizing pools, leveraging rehypothecation and auto-compounding strategies. By integrating bridges to Polkadot and Ethereum, Bunni optimizes cross-chain liquidity, attracting significant user traction and bullish sentiment from key opinion leaders (KOLs).

In contrast, EulerSwap, despite also crossing the $1 billion volume threshold, lags behind with minimal TVL growth and limited social buzz, highlighting the competitive dynamics within Uniswap v4’s ecosystem.The accelerated growth trajectory suggests broader DeFi trends, potentially amplified by AI-driven liquidity strategies that enhance capital efficiency and reduce impermanent loss. However, challenges loom, including fee fatigue and intensifying competition from other automated market makers (AMMs).

Analysts speculate that Uniswap v4 could hit $2 billion TVL by August’s end if it addresses fee-related concerns, though market sentiment remains cautiously optimistic.For deeper insights, platforms like dexanalytics.org offer granular TVL and trade flow data, while defillama tracks protocol metrics. As DeFi evolves, Uniswap v4’s integration of cutting-edge features positions it as a leader, though sustaining momentum will depend on innovation and user retention.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.