Injective (INJ) has made a significant technical breakthrough by surpassing the $15.96 resistance level, a barrier that had previously capped its price movement since February 2025.

This development is crucial as it indicates a potential shift in market dynamics, with the exhaustion of sell-side pressure from large holders (whales) at this level. The successful breach suggests that these whales are no longer defending the $15.96 price point, paving the way for further price discovery towards the $18–$20 range.

This momentum is supported by broader market trends, including the SEC’s approval of spot Bitcoin and Ethereum ETFs in 2024 and a clarifying statement in May 2025 regarding blockchain staking activities. Additionally, the recent filing for an Injective ETF by Canary Capital could further enhance investor interest and price momentum for INJ.

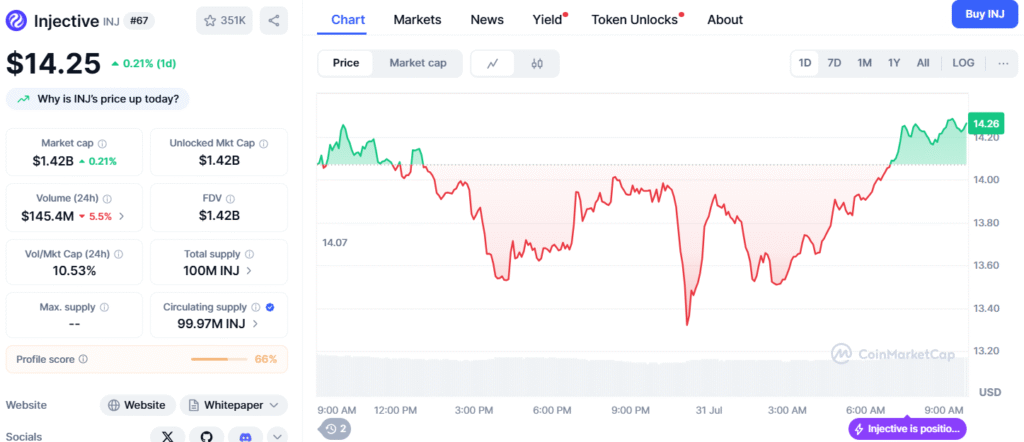

According to CoinMarketCap, as of today, $INJ is trading at $14.25 USD with a 24-hour trading volume of $145.4M USD and a market cap of $1.42B USD, reflecting a 0.21% increase in the last 24 hours, which supports the bullish outlook.

Additionally, Injective’s recent performance aligns with a market where altcoins are showing signs of recovery, despite Bitcoin’s consolidation phase. This breakout is a testament to Injective’s resilience and potential for growth, especially as it navigates through a period of increased regulatory clarity and investor confidence in the crypto space.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.