- Orderbook ratios remain negative, suggesting continued short-term seller control.

- Green volume stays low despite a structural base forming near $114K.

- Analysts see weak demand under range, risking bullish continuation failure.

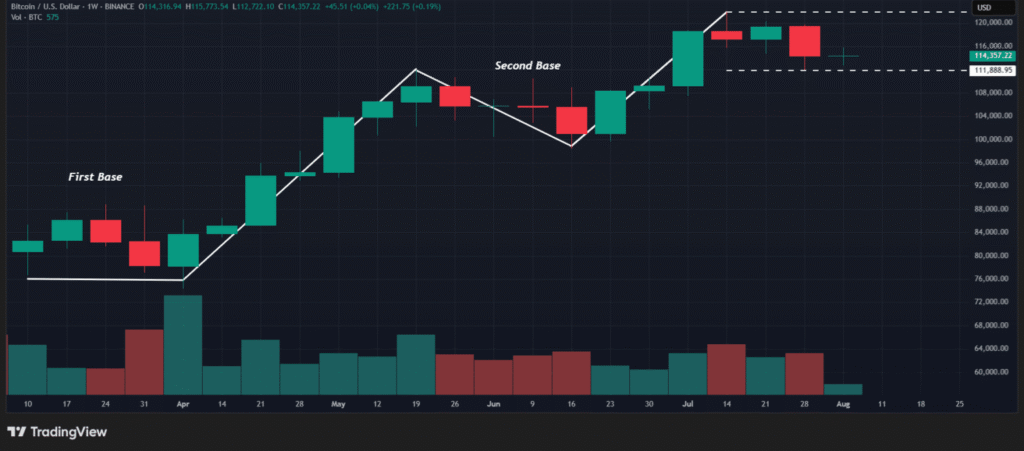

Bitcoin [BTC] closed July with a 4.26% red weekly candle, ending a multi-week upward trend. This marks the first notable correction since Q2 and may signal a momentum shift.

Accumulation Pattern Mirrors Past Setups, But With Differences

Since early Q2, Bitcoin has formed higher bases after moderate corrections. After a 5% drop near $77K, BTC entered a consolidation that led to a five-week rally, peaking at $109K. A second base between $105K and $109K launched BTC to its current all-time high of $123K.

Following four post-ATH weekly candles, BTC may now be forming a third base between $110K and $119K. Analysts note a short-side liquidity cluster worth $24 million centered around $114.5K and if swept, this level could trigger support confirmation.

However, traders emphasize that structure alone is not enough. Demand under the current range must strengthen for bullish continuation.

Orderbook Signals Show Bearish Tilt

Orderbook data from Binance Spot, via Hyblock Capital, shows a weak buy-side presence. The 10% Bid-Ask Ratio sits at -0.208, slightly better than the prior 24-hour average of -0.27. Still, the metric remains below neutral, indicating seller dominance.

The bid-focused histogram reads 0.044, down from the 24-hour average of 0.066. Both ratios remain under zero, pointing to limited short-term buying interest.

Analysts suggest that without a rise in bid-side support, price action could remain range-bound. Short-term rebounds from this level currently lack strong buyer conviction.

Volume Trends Fail to Confirm Bullish Setup

Meanwhile, volume behavior further weakens the bullish case. Weekly chart data shows rising red volume bars alongside declining green volume. During earlier base formations, upward price moves aligned with increasing green volume, confirming strong demand.

The current range shows no such follow-through. Analysts report that buying interest remains limited despite the potential formation of a new base. Without higher accumulation volumes, any price rally may be absorbed by active sellers.

At press time, BTC trades at $114,793.25, up 0.48% in the past 24 hours. However, continued weakness in order flow and volume signals suggest caution near current levels.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.