- $LINK could rise to $47 if it breaks $25 resistance, per Elliott Wave analysis.

- Current price at BTC0.0001796 with a 26.90% weekly gain outpaces the market.

- Chainlink’s oracle role boosts long-term potential amid growing adoption.

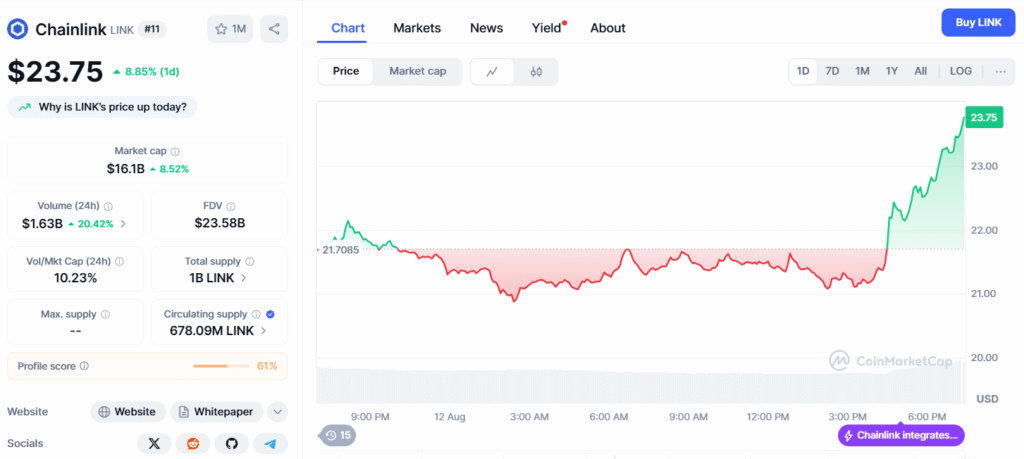

Chainlink’s native token, $LINK, is generating buzz among crypto traders following an insightful analysis from More Crypto Online on X.

The post, leverages Elliott Wave Theory to predict a potential bullish surge. The analysis suggests that a decisive break above the $25 resistance level could propel $LINK to a long-term target of $47, based on a fifth wave upside pattern observed in the provided charts. This forecast aligns with current market momentum, making it a hot topic in the crypto community.

Current market data from CoinGecko supports this optimism, with $LINK trading at BTC0.0001796 and boasting a 26.90% weekly gain, significantly outpacing the broader crypto market’s 4.60% increase. TradingView’s technical indicators also flash a buy signal, reinforcing the bullish sentiment. The charts shared by More Crypto Online highlight key support and resistance levels, including a micro support zone around $20 and a critical $25 threshold. A breakout above this level could trigger significant upside, driven by increased trading volume and investor interest.

Chainlink’s fundamental value adds credence to this technical outlook. As a leading oracle network, it connects smart contracts to real-world data, a role that has gained traction with growing blockchain adoption. The LINK token, used for transaction fees and staking, could see heightened demand if institutional or governmental use cases expand, as suggested by recent developments like Chainlink’s data streams for U.S. equities. The post’s long-term chart projection to $47 reflects this potential, though traders should remain cautious of volatility and monitor support levels closely.

As the crypto market evolves, $LINK’s performance will be worth watching. The combination of technical analysis and underlying utility positions Chainlink as a contender for significant gains in the coming months.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.