- HashGlobal predicts BNB could hit $2,000+, supported by technical breakout analysis.

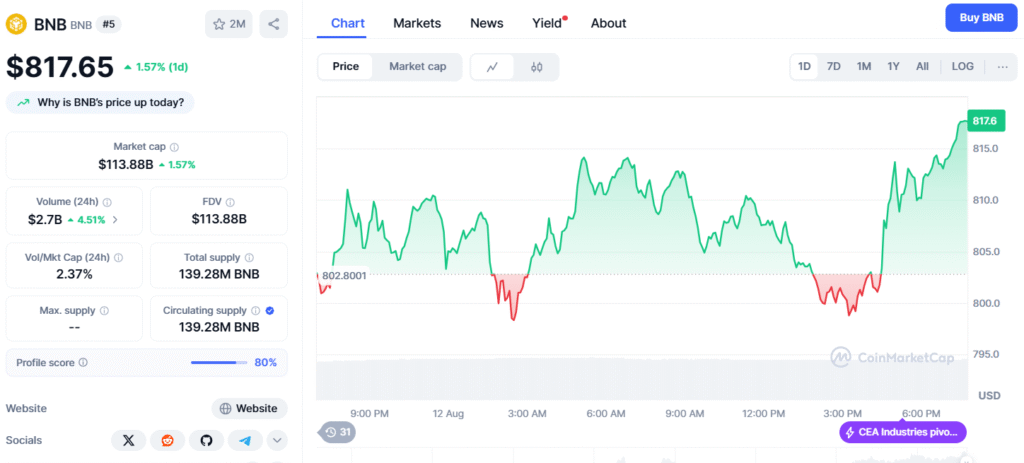

- BNB’s current price is $804.87 USD, with a $112 billion market cap despite a recent dip.

- Regulatory risks and CZ’s departure add uncertainty to the bullish forecast.

The cryptocurrency community is buzzing with excitement over a bold prediction from HashGlobal, shared by crypto analyst Crypto Patel on X.

The forecast suggests that Binance Coin (BNB) could skyrocket to $2,000 or more, a claim backed by a detailed chart highlighting historical price patterns and potential breakout zones. This bullish outlook comes at a time when BNB’s current market cap stands at $112 billion USD, with a live price of $817.87 USD, despite a recent 2.07% dip in the last 24 hours, according to CoinMarketCap data.

The chart, shared by Crypto Patel, emphasizes technical analysis, identifying key support and resistance levels that could propel BNB toward this ambitious target. This aligns with CoinPedia’s earlier prediction of BNB reaching $2,292 by the end of 2025, driven by Binance’s expanding ecosystem, innovative token listings, and high trading volume. The post also credits Changpeng Zhao (CZ), Binance’s former CEO, for steering the project’s growth, though his 2023 resignation following a U.S. money laundering charge introduces regulatory uncertainty—a factor often overlooked in such forecasts.

However, this optimism must be tempered with caution. Research from the Journal of Finance (2022) highlights how cryptocurrency momentum can lead to significant price swings, while a 2024 National Bureau of Economic Research study warns that regulatory risks could dampen long-term gains. With BNB’s all-time high of $793.35 in December 2024 and potential for exponential growth to $436,557.73 or even $3.39 million by 2050, the $2,000 target seems plausible in a bullish market but hinges on favorable conditions.

For investors, this prediction offers a tantalizing opportunity but underscores the need for diligent research. As the crypto landscape evolves, staying informed on technical trends and regulatory developments will be key to navigating BNB’s potential ascent.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.