- Legal resolution and ETF expectations fuel renewed XRP market optimism.

- Analysts highlight $3.13 support as critical for sustaining the bullish trend.

- Short squeeze potential emerges if $3.11 support level holds firm.

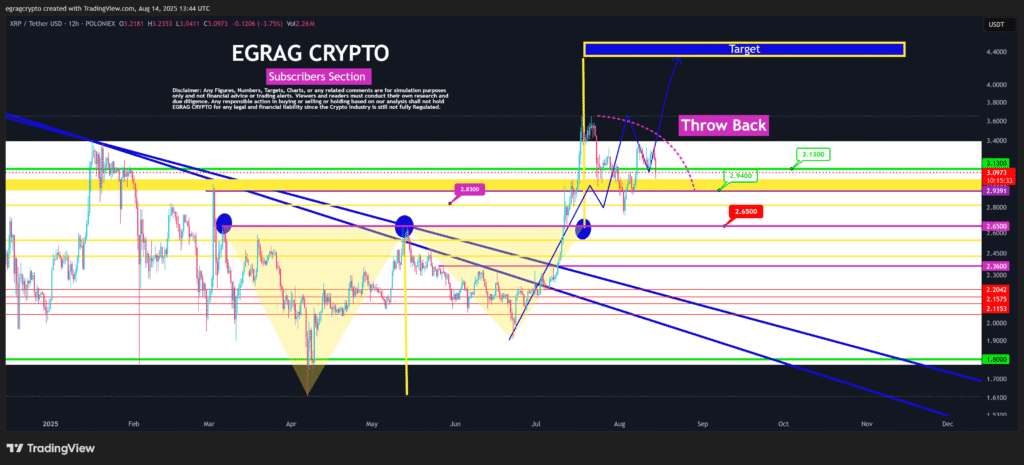

XRP is showing renewed strength after a series of major developments. EGRAG Crypto reported that XRP’s macro trend remains bullish under a “throwback” pattern.

The analysis indicated that liquidation risks are reduced as long as XRP holds above $3.13 on the daily chart. A decline toward $2.65 would need confirmation of strong support before posing further downside risk.

The $3.30 level is marked as critical resistance, and three daily closes above it are needed to remove bearish sentiment. The projected target zone is above $4.00.

EGRAG described the macro outlook as “Super MEGA Bullish” and urged the XRP community to remain steady, suggesting collective strength will help the price rise further.

Frankfurt Exchange Legal Case Update and ETF Outlook

The Frankfurt Stock Exchange announced that Ripple’s legal case is reportedly resolved, triggering optimism in the crypto market. An XRP spot ETF is expected to follow, potentially allowing direct investor exposure and encouraging broader adoption.

Traders believe such a product could drive fresh institutional inflows. Market reaction has already leaned bullish, with observers noting the development could become a landmark moment for XRP’s growth.

Former U.S. President Donald J. Trump also commented on cryptocurrency, saying it could fix the “broken financial system.” He stated, “X marks the spot,” and spoke of creating a “splash” that sends “Ripples” globally.

His remarks sparked speculation about possible support for XRP, adding to the asset’s growing narrative momentum.

Volatility Surge and Analyst Reaction

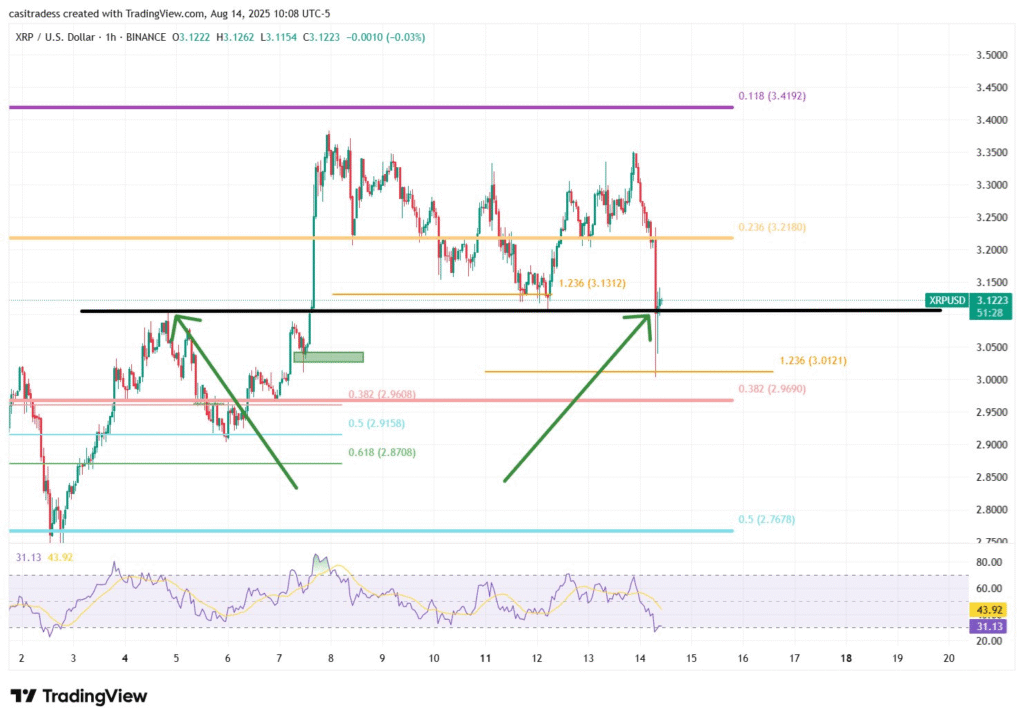

XRP experienced sharp volatility when it dropped 7% in 15 minutes, causing $420 million in crypto liquidations. Analyst CasiTrades reported the fall from $3.21 support to $3.00 before rebounding to $3.11.

CasiTrades suggested the move resembled a liquidity hunt, with the price respecting key Fibonacci retracement levels, including the macro 0.382 at $3.00. The analyst stated the bullish structure remains valid as long as $2.76 holds. Resistance levels are identified at $3.21, $3.41, and $3.66, with a macro target near $4.70.

According to CasiTrades, sustaining $3.11 support could trap short positions and trigger renewed upward momentum. With technical, legal, and market factors aligning, analysts are closely tracking price behavior in the coming sessions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.