- Insider wallets secured huge profits before $YZY’s rapid market collapse.

- Liquidity imbalance in $YZY mirrored past risks from $LIBRA.

- Heavy shorting pressure worsened token’s fall, fueling volatility concerns.

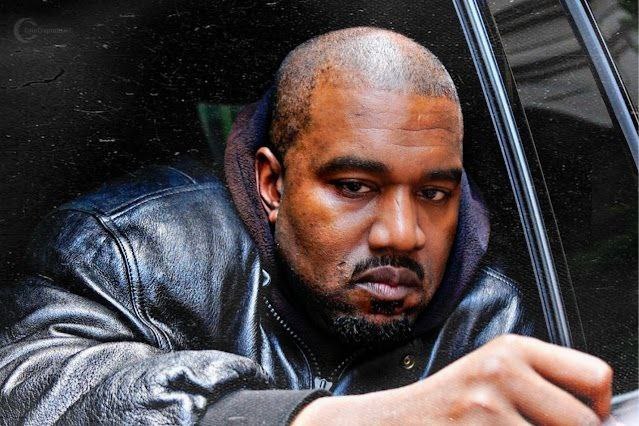

Kanye West’s new Solana-based token, $YZY, crashed within hours of launch. $YZY’s price dropped more than 65% in its first trading session.

One trader on Hyperliquid reportedly opened a short position with 3x leverage, now showing $202,000 in unrealized profit. The token marked a 60.5% gain as its price tumbled.

Analysts from Spot On Chain said the speed of the decline showed the volatility risks tied to new listings. They added that heavy shorting pressure likely accelerated the crash.

The launch initially pushed $YZY to a $2 billion market cap within minutes. Liquidity inflows crossed $120 million at the start.

However, traders noted that the setup was unusual because all liquidity was added in $YZY without USDC backing. This raised concerns over stability and sell-side depth.

Liquidity and Structural Red Flags

Spot On Chain analysts compared the liquidity setup to the failed $LIBRA project, where imbalances created rapid shifts. The lack of USDC in pools allowed developers more influence over trading conditions. This structure drew immediate criticism from researchers tracking on-chain movements.

Crypto Patel stated that while hype around celebrity-backed tokens is strong, red flags are equally visible. He urged investors to conduct independent research before entering such markets.

Insider Activity and Early Profits

Blockchain monitors also flagged insider involvement during the launch. Lookonchain reported that a wallet identified as 6MNWV8 interacted with the contract before trading opened.

The wallet spent 450,611 USDC to acquire 1.29 million $YZY at $0.35. It later sold most holdings for $1.39 million while retaining $600,000 worth of tokens. The strategy secured over $1.5 million in profit within hours.

Analysts noted that insider wallets had been pre-funded ahead of launch, raising further transparency concerns. The combination of structural liquidity risks and insider trading activity was cited as a key driver behind the rapid decline.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.