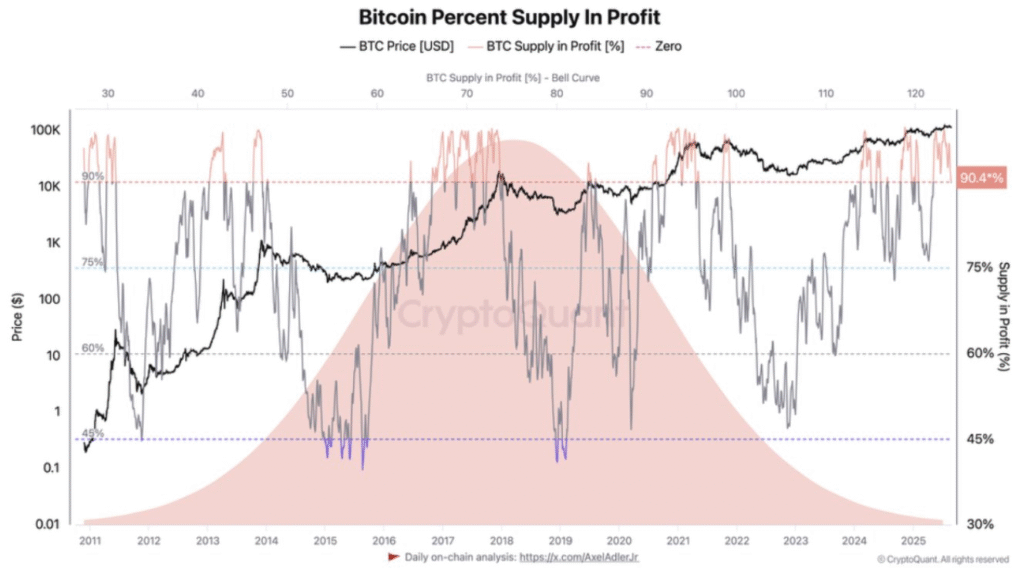

- Over 90% of the Bitcoin supply is profitable, signaling possible correction risk.

- BlackRock adds $51.39M Bitcoin, showing confidence during volatile phases.

- Price tests $110K–$105K support zone, trend depends on holding.

Bitcoin’s profitability levels have reached a historically critical point. CryptoQuant data shows that more than nine out of ten Bitcoin units are trading above their cost basis.

Analysts reported that in past cycles, when profitability dropped below 90%, the market often entered corrective phases.

Historical charts highlight that both short-term and long-term retracements followed these declines. Analysts warned that such extreme profitability levels tend to align with heightened volatility.

They added that while many investors see it as a sign of strength, it also represents a potential turning point for momentum.

BlackRock Expands Bitcoin Holdings

Institutional demand remains strong despite volatility signals. Blockchain data shows BlackRock purchased $51.39 million worth of Bitcoin in recent transactions. The inflows were directed into the firm’s IBIT fund wallets, with Coinbase facilitating multiple transfers.

Records reveal more than 454 BTC were added through separate deposits. Analysts stated that these inflows during market corrections demonstrate confidence in Bitcoin’s long-term trajectory.

Price Action and Technical Structure

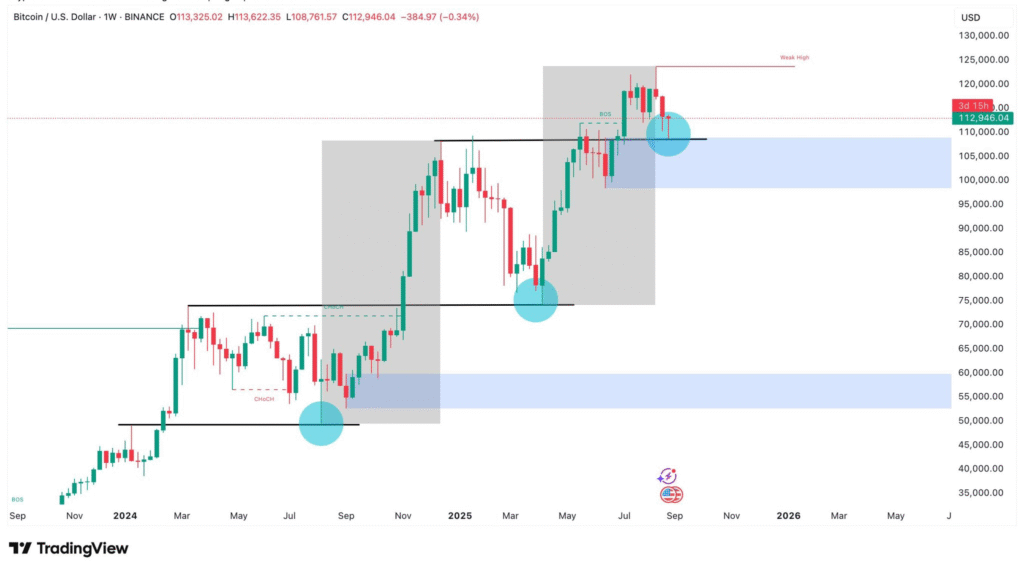

Bitcoin is currently trading at around $112,946 after facing resistance of around $120,000. Technical analysts observed a recurring structural pattern on the weekly chart, marked by repeated accumulation phases and breakout moves.

Recent pullbacks in 2024 and early 2025 displayed similar behavior, where demand zones triggered renewed rallies. The present correction is testing a critical support range between $110,000 and $105,000.

Analysts highlighted this as a decisive zone, suggesting that holding above it could confirm continuation toward higher levels. They pointed to $125,000 as the next “weak high” that may be tested if support holds.

However, failure to defend the current range could expose Bitcoin to deeper retracement levels between $95,000 and $100,000. Analysts described this moment as a key test for the mid-term trend.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.