- $221M BTC Dump – A whale sold 2,000 BTC through Hyperliquid, creating immediate supply pressure on Bitcoin’s price action.

- $3B ETH Accumulation – The same entity accumulated 691,358 ETH in total, solidifying a massive long-term bet on Ethereum.

- Rotation Narrative Emerging – Bitcoin consolidation contrasts with Ethereum resilience, signaling a potential market shift in capital flows.

The crypto market witnessed a significant shift when a whale actively sold $221 million worth of Bitcoin and invested the proceeds in Ethereum, triggering speculation that a capital redistribution trend may have emerged. Bitcoin was selling poorly, and Ethereum was in the midst of a multi-billion-dollar buildup to take over the short-term mood. A potential shift in dominance from BTC to ETH was being discussed.

Bitcoin Faces Pressure After Whale Sell-Off

A large Bitcoin holder executed two massive transactions, unloading 2,000 BTC worth $221 million within a short window. The funds moved through Hyperliquid, where the whale deposited 1,000 BTC twice before liquidating positions. The sales created immediate supply pressure on Bitcoin’s market while triggering broader speculation about capital reallocation.

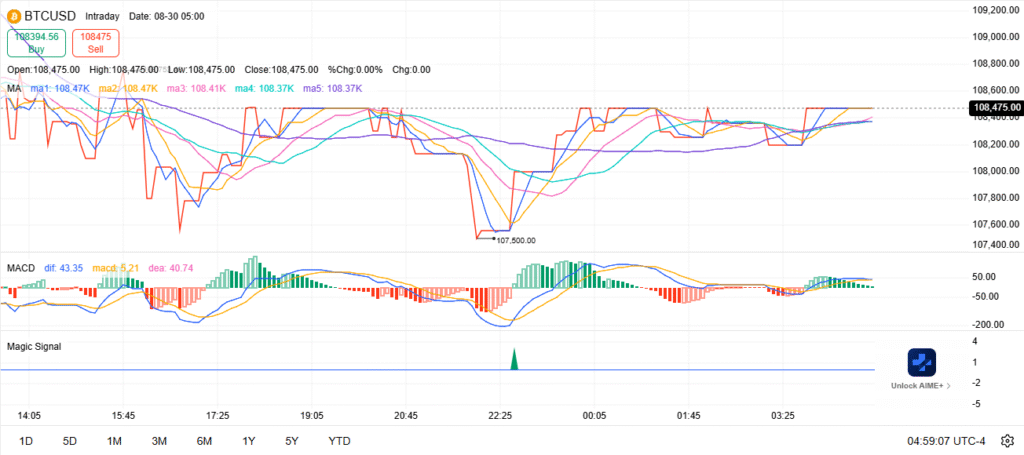

The exercise points to major selling momentum which may impact negatively on Bitcoin in the short-run. Bitcoin ranged around its previous day low of $108,475, having recovered an intra-day low of 107,500. Moving averages were clustering around the range of $108,370 to $108,470 as it indicates indecision and low momentum.

The MACD indicator of Bitcoin revealed that its momentum was fluctuating with a slight positive cross-over. Though there was a soft bullish message, the histogram became flat indicating weakening. The price action was kept within the range with the support at about 107,500 and the resistance at 108,600 determining the immediate picture.

Ethereum Strengthens With Whale Accumulation

Ethereum absorbed the capital shift as the whale converted BTC into nearly 49,850 ETH valued at $219 million within 12 hours. This move lifted total ETH accumulation to 691,358 tokens, valued at approximately $3 billion. The transaction flow demonstrated strategic execution with multiple deposits, likely designed to reduce slippage.

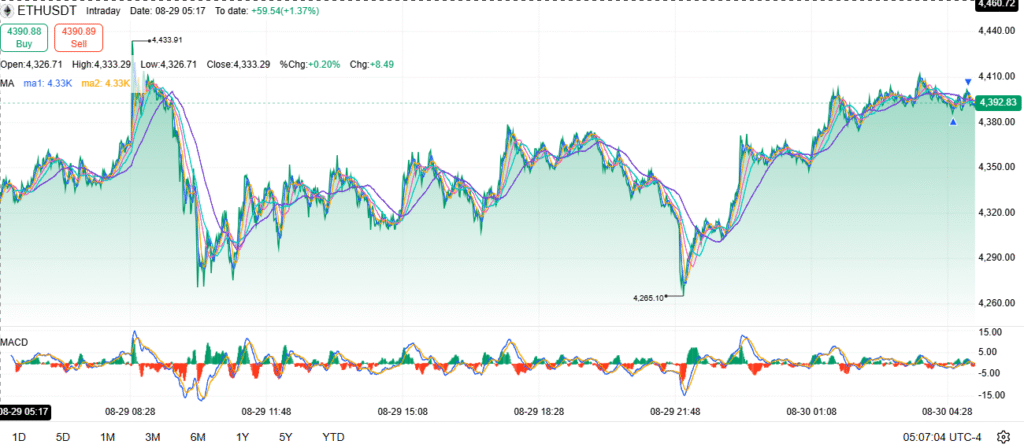

ETH traded around $4,392.83, posting a daily gain of 1.37 percent. Price action showed resilience, recovering quickly from a sharp dip to $4,265. The rebound reinforced $4,260–$4,280 as a solid support zone, while resistance stood between $4,410 and $4,433.

Moving averages aligned near $4,330, supporting a bullish undertone. The MACD indicator turned positive, with the line crossing above the signal. Momentum appeared modest but pointed to potential continuation if buying strength increased.

Broader Market Implications

The whale’s rotation strategy signaled strong conviction in Ethereum’s relative strength compared to Bitcoin. The scale of accumulation positioned the entity among the largest ETH holders globally. This pattern reflected not a one-time adjustment but a deliberate reallocation strategy.

The shift added immediate demand pressure to Ethereum while simultaneously creating selling weight on Bitcoin. Consequently, ETH showed relative outperformance while BTC entered consolidation. This dynamic could fuel a broader narrative of capital rotation between the two leading cryptocurrencies.

In conclusion, Bitcoin faced pressure from whale selling while Ethereum gained strength from massive accumulation. Market structure now reflects a potential rebalancing trend.

Disclaimer: The information in this press release is for informational purposes only and should not be considered financial, investment, or legal advice. Coin Crypto News does not guarantee the accuracy or reliability of the content. Readers should conduct their own research before making any decisions.