- POL price rose 13% today, trading at $0.2750 with rising volume near resistance.

- Polygon TVL grew 43% this year to $1.23B as DeFi inflows accelerated.

- 97% of MATIC to POL migration is complete, unifying the Polygon ecosystem.

Polygon’s POL token is drawing attention as its price moved sharply higher this week. The asset gained 13% today and reached around $0.2750, while traders are watching for a possible breakout from a long-term resistance zone.

The move comes as the project’s final token migration stage nears completion, with adoption metrics and upgrades adding to market confidence.

Fundamentals Support Price Strength

Polygon’s Total Value Locked has risen 43% since the start of 2025, now standing at $1.23 billion. Decentralized finance activity has been a strong contributor to this growth, with protocols such as QuickSwap attracting steady inflows.

Stablecoin transactions on Polygon have also expanded. In July alone, $2.56 billion in stablecoin payments were processed. During that period, the network recorded over 3.16 million active USDC addresses, showing wider usage by retail and institutional users.

Upgrades to the network have helped improve speed and efficiency. The Heimdall v2 upgrade reduced transaction finality to five seconds. This adjustment has been viewed as an important step toward scalability and improved user experience across applications built on Polygon.

The migration from MATIC to POL is nearly complete, with more than 97% of tokens already converted. This effort is expected to streamline the ecosystem under a single native token and reduce fragmentation.

Technical Setup Points to Breakout

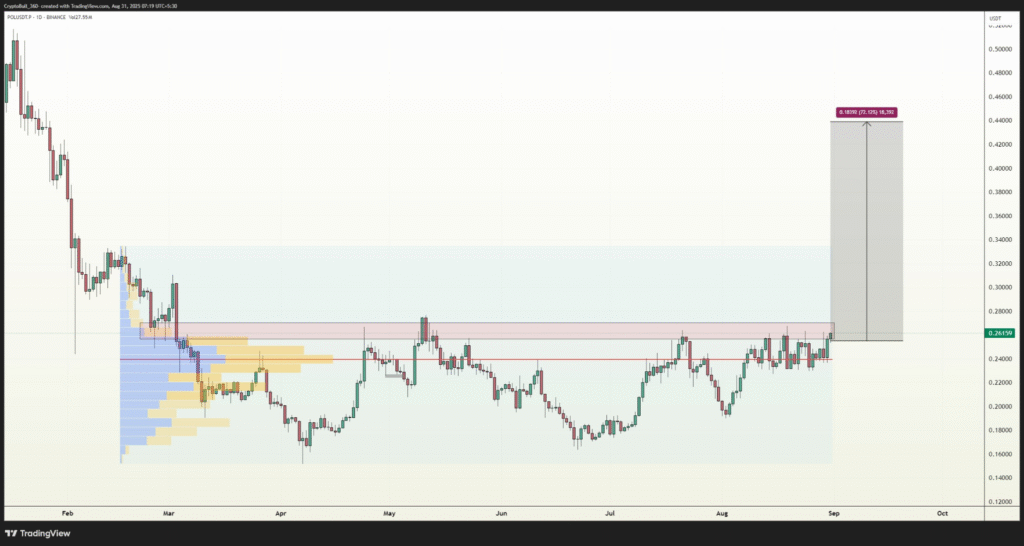

On the daily chart, POL has been consolidating below a resistance zone that has rejected price advances several times in recent months. The recent surge has brought the price back to the same level, but the setup is showing stronger buying pressure than before.

Trading volume has been increasing, suggesting growing interest as price moves into a critical zone. According to data shared by market analysts, consistent buying attempts keep pressure on resistance. If the level is cleared, the price setup could support an 80–100% move higher into the $0.45–$0.55 range.

Support remains near $0.23, which provides a cushion if short-term profit-taking occurs. Spot selling of around $263,000 and a $9.88 million decline in derivatives open interest have been recorded, but buyers remain active.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.