- XRPL RWAs reached $131.6M market cap in Q2 2025, the highest to date.

- XRP closed Q2 2025 with $132B market cap, rising 8.5% from Q1.

- RLUSD stablecoin grew to $455.2M across XRPL and Ethereum in Q2.

The XRP Ledger (XRPL) recorded strong growth in the second quarter of 2025. Messari reported that the market capitalization of real-world assets on XRPL reached $131.6 million at the end of June, the highest level to date.

The growth was supported by new issuances presented at the XRPL Apex event in Singapore. These included tokenized real estate from Ctrl Alt, digital commercial paper from Guggenheim, and the OUSG Treasury fund from Ondo. Each of these projects expanded what could be represented on XRPL.

Infrastructure also advanced during the quarter. Analytics provider RWA.XYZ integrated XRPL into its platform in March, allowing users to track the performance of tokenized assets. By the end of the quarter, thirteen RWAs had been added, and further integrations are expected.

XRP Maintains Position Among Leading Cryptocurrencies

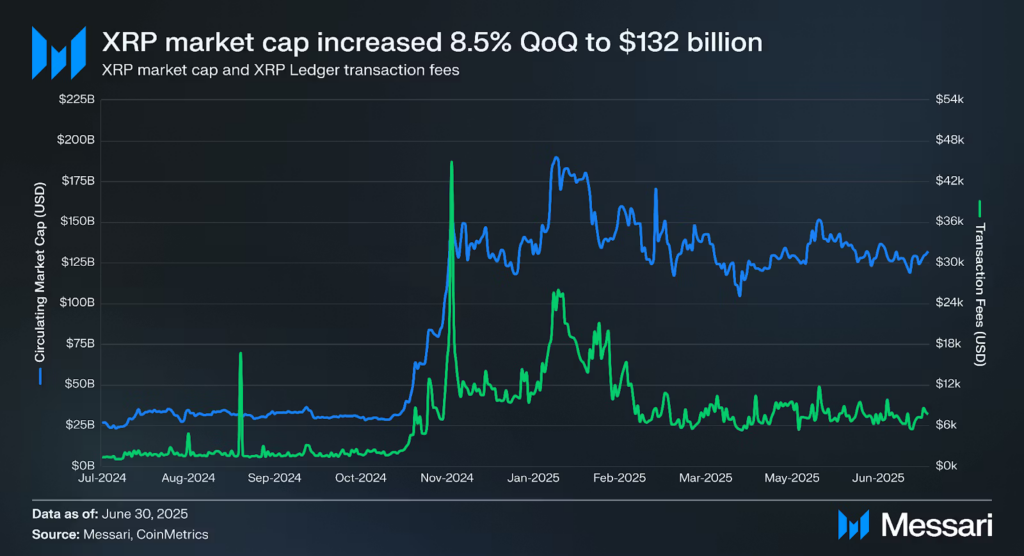

XRP also recorded gains in Q2 2025. By the end of June, its market capitalization reached $132 billion, up 8.5% from the previous quarter. Over the same period, the token’s price increased by 7.1%.

Momentum extended into July, as XRP’s market value rose further to $166.8 billion. Messari data confirmed that XRP closed the quarter as the fourth-largest cryptocurrency by market capitalization.

While asset growth continued, network fees decreased. XRPL operates differently from many blockchains, as fees are permanently destroyed instead of distributed to validators. Fees collected fell by 38.7% in dollar terms, dropping from $1.1 million to $680,900. In XRP terms, fees fell 27.4% from 425,300 to 308,700 tokens.

Stablecoin RLUSD Expands Across XRPL and Ethereum

Ripple’s RLUSD stablecoin showed strong growth across XRPL and Ethereum in Q2. Combined market capitalization reached $455.2 million by June.

On XRPL, RLUSD ended the quarter with $65.9 million in value, a rise of 49.4% from the previous quarter. Ethereum issuance accounted for the rest. More recent data placed RLUSD’s market cap at $701.6 million, with $85.9 million on XRPL and $615 million on Ethereum.

These developments showed continued adoption of RLUSD, growth in tokenized real-world assets, and strength in XRP’s market position as Q2 2025 closed.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.