- XRP/ETH stabilized near 0.0006380 ETH, forming a demand zone that often precedes renewed market momentum.

- Daily and three-day bullish divergences, combined with RSI above 50, signal potential upside strength against Ethereum.

- Nine months of XRP/USD consolidation above historic highs create a strong base for future breakout expansion.

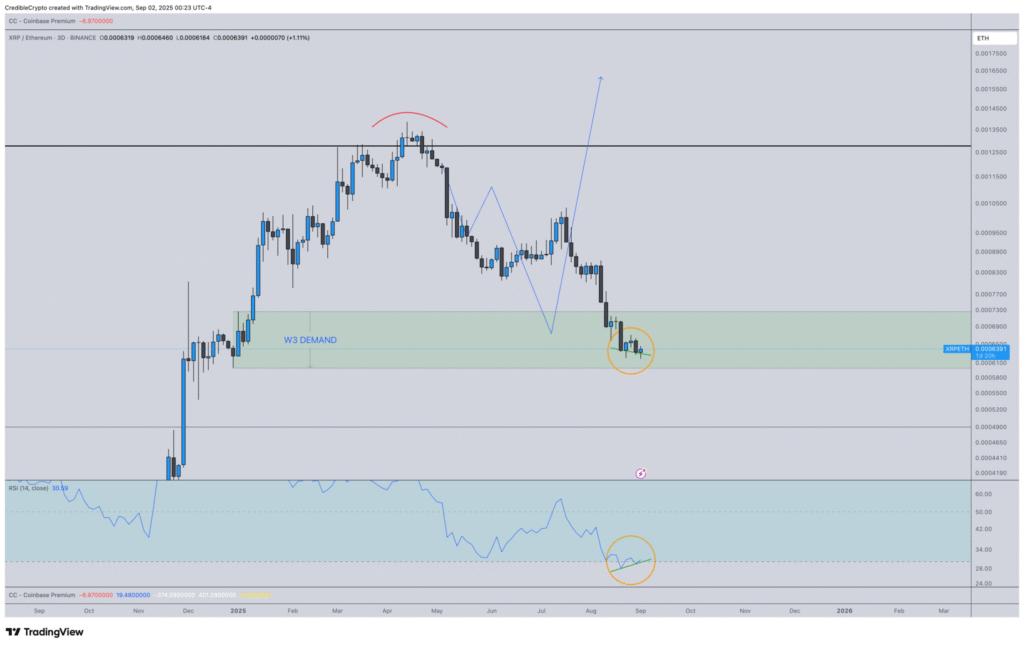

XRP is showing early signs of resilience against Ethereum after months of correction. The pair recently stabilized near 0.0006380 ETH. This level represents a key demand zone where support has historically triggered renewed momentum.

Bullish divergences have appeared on both daily and three-day charts, strengthening the outlook for potential upside. These divergences indicate momentum rising despite weaker price action. Such conditions often precede rebounds and can support sustained shifts in trend direction.

Momentum indicators confirm this view as well. RSI has climbed above the neutral 50 level, while MACD remains in positive territory. Both signals highlight consolidation, suggesting the market could prepare for another upward phase.

XRP/USD Price Structure

XRP has held firm against the dollar, maintaining strength above historic levels. The coin has now consolidated for nine months near its highest monthly close. This extended consolidation points to a strong base of support and possible expansion.

The prolonged structure provides stability and reduces immediate downside pressure. It also signals that participants are comfortable with current valuations. Such stability often precedes breakout attempts when demand begins to build again.

The broader pattern shows a market that completed a rally, absorbed a correction, and is now stabilizing. XRP has defended critical price zones, highlighting resilience against selling pressure. This long-term structure strengthens arguments for future upward continuation.

Broader Market Implications

XRP’s recovery setup highlights the potential for relative strength against Ethereum in the coming months. Historical accumulation zones continue to offer important support levels. A strong rebound from these areas could drive renewed momentum.

Ethereum remains near resistance levels, which contrast with XRP’s stabilizing structure. This divergence highlights how XRP may secure relative gains. Momentum indicators suggest that a shift in market preference could already be underway.

The current cycle reflects strength building after correction. If consolidation holds, XRP could enter a new expansion phase. Market dynamics therefore favor XRP’s resilience and potential breakout momentum.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.