- Historical Repetition – The move to the $110K range is historically consistent with Bitcoin (2015, 2018, 2020), and at times the stage before a parabolic surge.

- Critical Support Zone – Sustained strength over $110,000 may provoke the next push to $120,000, and decline may provoke support at 100,000.

- Rebalancing Phase- Current sideways trading indicates accumulation, and market structure indicates that Bitcoin is about to experience another significant breakout.

Bitcoin has started September with a newfound feeling of strength and with trends that are reminiscent of previous recovery and growth cycles. Although it declined by 1.21 on a daily basis, the bigger picture shows strength approaching the $110,000 area. The market is perhaps positioning towards another rally as implied by the current setup assuming historical trends take place.

Past Trends Indicate the possibility of a rally.

Previous cycles in 2015, 2016, 2018, 2019, and 2020, 2021 provided periods of consolidation, followed by parabolic explosions. The highlighted periods were all accumulating phases in which strong hands were receiving selling pressure. These cycles were always followed by acute market gains, which has formed the pattern that analysts now perceive in the 2022 2023 cycle.

The current lateral trend resembles the previous cycles where the price stability creates a platform where the breakout activity may occur. The market trends show that weak players have already left the market but long-term holders are acquiring. Such a dynamic tends to precondition significant upward movements.

Should history repeat, the next parabolic rise of Bitcoin would be happening, off the consolidation base. Although the future is not clear, positive trends in the past provide some credibility to optimism. Such a cycle would be part of the wider reputation of Bitcoin as performing in difficult markets.

Bitcoin Holds Key Levels Around $110K

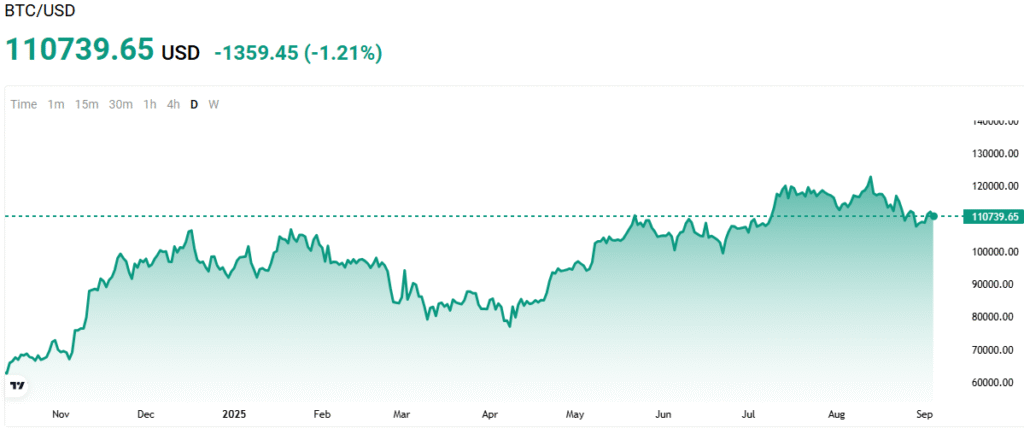

Bitcoin is currently trading at 110,739.65 as it consolidates following a turbulent year with rallies and downturns. The coin went as low as less than 70,000 in late 2024, and as high as around 120,000 in mid-2025. The driving force has declined since then, and the support is at $110,000, and the resistance still remains above the 120,000 mark.

Source: mitrade

The chart indicates phases of sharp rallies and then phases of long sideways pricing action. Sharp gains were recorded in December of 2024 that reversed in early 2025. This optimism was supported by a recovery in May and was capped by selling pressure towards the summer peak.

The present consolidation of the Bitcoin market places the market in an equilibrium position between the areas of support and resistance. A level of above $110,000 could spur a new drive to $120,000. But falling below may reveal prices around the 100,000 mark that has already served as a psychological support.

Market Prognosis Indicates Re-equilibrium.

Bitcoin is in the middle point of its annual chart indicating a larger period of rebalancing. The ability to maintain stability within this range can enable gradual accumulation of the next directional move. This act is in line with the overriding theme of time cycles.

The pattern of consolidation prior to rallies gives an indication that Bitcoin might be on the precipice of its next major move. Market structure bears some resemblance to previous bullish formations that had led to powerful breakouts. These conditions usually arise when they are robbed of supply and demand accumulates slowly.

With Bitcoin still in this stage, the focus is still on whether this currency will manage to stay afloat. A strong break to the higher would reinforce the momentum and additional weakness would challenge the strength of its long term structure. The next few weeks could determine whether this September can be another turning point of the leading cryptocurrency.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.