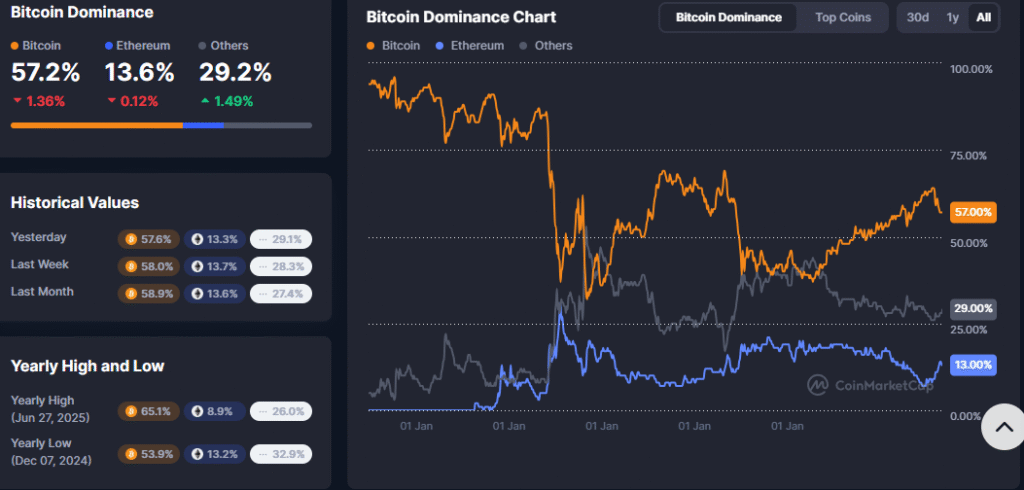

- Capital rotation from Bitcoin dominance into altcoins signals the potential start of a strong altcoin season.

- Ethereum remains steady at 13.6% while smaller altcoins surge to 29.2%, reflecting rising diversification trends.

- If Bitcoin holds steady, altcoins could see extended rallies, though volatility risks remain in the short term.

Bitcoin dominance dropped sharply below 58%, marking a significant shift in crypto market dynamics. This decline suggests capital rotation from Bitcoin into altcoins. Such conditions have historically triggered periods of stronger altcoin performance across the market.

The latest chart shows a steep red candle reflecting a sharp decline in Bitcoin’s market share within hours. These moves usually coincide with fresh liquidity inflows into altcoins as traders seek higher returns. Historical data shows similar declines often precede rallies known as altcoin seasons.

As Bitcoin consolidates, sidelined liquidity tends to shift toward smaller and mid-cap tokens. This rotation creates strong price appreciation across alternative assets with compelling narratives. The ongoing decline in dominance adds momentum to sentiment supporting an altcoin-led market rally.

Although this setup favors altcoins, volatility remains a key factor. If Bitcoin falls further, altcoins may face stronger swings despite dominance shifts. However, if BTC holds steady while dominance falls, altcoins could maintain extended gains across multiple sectors.

Historical and Yearly Trends

Bitcoin dominance has dropped from 58.9% a month ago to 57.2% today, showing a clear redistribution of market share. Ethereum now holds 13.6% while altcoins collectively climbed to 29.2%, signaling broader market participation. The shift points to growing appetite for diversification away from BTC.

Source: Coinmarketcap

The yearly high was recorded at 65.1% in June 2025, highlighting Bitcoin’s control during mid-year. In contrast, the yearly low of 53.9% in December 2024 reflected stronger altcoin rallies. Current values show the market trending closer to conditions favoring altcoins again.

Over the last week, Bitcoin’s dominance declined from 58.0% to 57.2%. This steady reduction underlines continued pressure on BTC’s market share. Altcoins continue to absorb liquidity flows, strengthening their collective positioning.

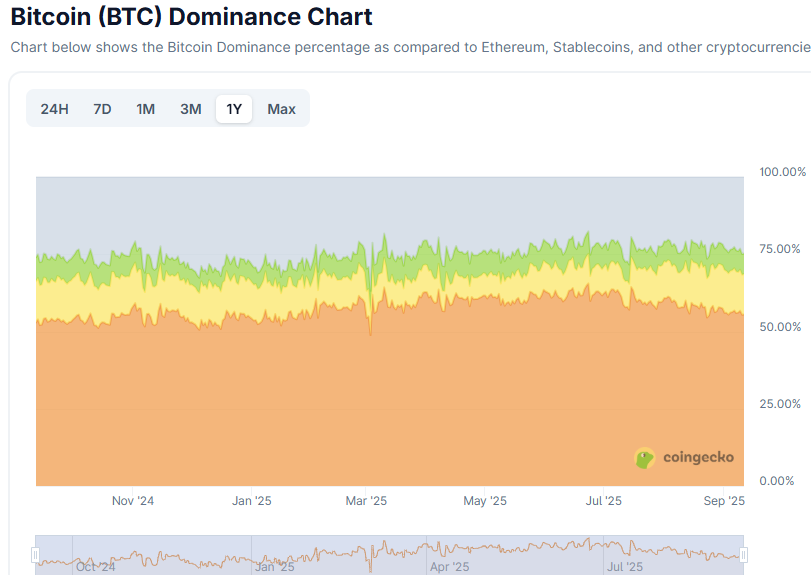

Ethereum and Altcoin Growth

Ethereum’s market share has remained stable between 13–14%, reflecting its established role despite changing market conditions. However, the rise of smaller altcoins has been more pronounced. Their combined dominance has reached above 29%, reinforcing the shift toward broader diversification.

Source: Coingecko

This increase in Others category suggests growing interest in smaller-cap tokens and emerging narratives. These projects are absorbing capital as traders seek new opportunities. The trend highlights rising confidence in altcoins beyond the top two.

If Bitcoin stabilizes near its current levels, conditions remain favorable for altcoin outperformance. Sustained capital rotation could continue driving momentum across a wide range of alternative tokens. However, any sharp moves in BTC could still introduce volatility across the sector.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.