- SUI nears $4, a key resistance level, but weak volume limits bullish momentum.

- SUI bulls face hurdles as the $4 resistance zone grows tougher to break.

- Volume profile analysis suggests potential rejection at $4, sending SUI back to $3.5.

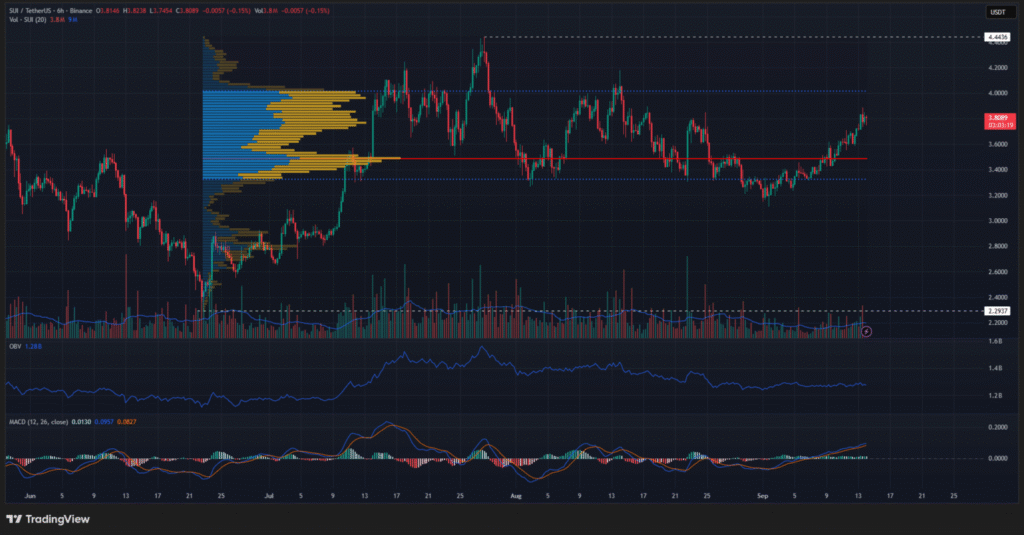

Sui (SUI) has shown impressive bullish momentum since late 2024, but its short-term price action is now facing a key challenge at the $4 resistance. At press time, SUI is trading at $3.79, still under the critical resistance zone of $4.

As of mid-September 2025, SUI was attempting to break above $3.5 but lacked strong buying volume to support further upward movement. This has raised questions about whether the altcoin can surpass the $4 barrier anytime soon.

Key Resistance at $4

The $4 level remains a tough obstacle for SUI, which could face rejection if buying momentum doesn’t pick up. A Fixed Range Volume Profile analysis suggests the Value Area High near $4 is crucial, marking a critical resistance zone. This level is also psychologically significant for traders as it represents a round number.

While SUI’s recent price action shows that bulls have been able to push the price above $3.5, they are struggling to gather enough support for a move beyond $4. The lack of substantial buying volume over the past few weeks means that a breakout could take longer than expected.

Weak Buying Volume Hinders Bulls

Despite SUI’s bullish trend in 2024, the recent trading volume has been underwhelming. On-Balance Volume (OBV), a key indicator of buying pressure, has remained below average in September, signaling that momentum may not be strong enough to push prices higher.

In the 6-hour chart, the OBV only showed a slight increase compared to early September, indicating a lack of conviction among buyers.

With low buying pressure, the likelihood of SUI breaking through the $4 resistance without further volume increases is low. If the breakout fails, SUI may retrace to the $3.5 support level, which aligns with the Point of Control in the volume profile.

Next Steps for Traders

For those looking to trade SUI, the focus will be on the $4 resistance and how the price reacts to it. A breakout above $4 would require stronger buying volume, which could signal sustained bullish momentum.

On the other hand, a rejection at this level could bring the price back to the $3.5 support zone. As SUI approaches this critical point, traders are advised to remain cautious and watch for changes in volume and price action to guide their next steps.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.