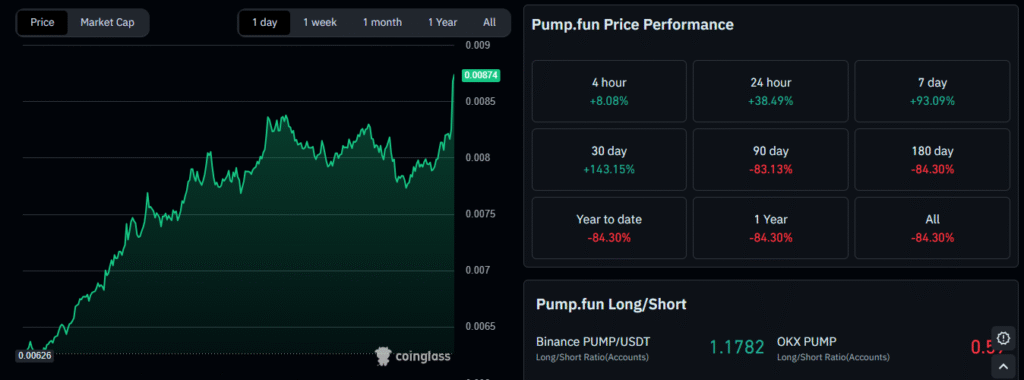

- Short-Term Surge: $PUMP surged 177 percent and increased 38 percent in a day as the volume of its trade surged 161 percent to $1.32B.

- Mixed Market Sentiment: Binance records indicate that the long-term orientation is bullish with OKX pointing to more intense short orientation, which indicates divided trader sentiment.

- Recovery vs. Risk: $PUMP is still below year-to-year levels by 84 percent, indicating its erratic long-term trend, even though it is strong in the short term.

Pump.fun (PUMP) has increased over 38 per cent in the last 24 hours to a high of $0.008736 with a healthy market. The volume of trading increased by more than 161 percent in the same time, passing over $1.32 billion. The price breakout has strengthened the short-term bullish price movement that has attracted focus on its quick recovery.

Strong Rally and Momentum

$PUMP delivered a 177% rally after breaking out of recent consolidation. The move came after the token crossed a descending trendline. This shift in structure indicated renewed strength and broader market interest.

Momentum now suggests a short consolidation phase could develop. Such phases often allow markets to stabilize before further extension. Sustained buying above recent highs could create conditions for another upward move.

Price behavior shows resistance at current levels. If stability holds, the next leg upward could follow consolidation. Strong volume support would confirm this continuation.

Price Performance Across Timeframes

Short-term returns remain impressive. The token gained 93% in the last week and surged 143% over the past 30 days. These numbers show aggressive accumulation and renewed optimism.

However, longer-term performance paints a different picture. PUMP has lost over 83% in the last 90 and 180 days. Year-to-date, the decline still stands at 84%.

Source: Coinmarketcap

The contrast between near-term gains and extended losses highlights the token’s volatility. Momentum traders see opportunity, while longer-term holders assess sustainability. This divergence underscores the uncertainty surrounding PUMP’s trajectory.

Market Position and Outlook

Circulating supply stands at 354 billion tokens, with total supply capped at 1 trillion. Strong liquidity underpins current activity. Market participation has remained elevated, reflecting broad trading interest.

Source: Coinglass

Data from long/short ratios signals mixed sentiment. On Binance, the ratio shows more long exposure, highlighting short-term bullish leanings. On OKX, however, stronger short positioning suggests caution across that exchange.

PUMP now holds a prominent place in Solana’s ecosystem, controlling major volume on memecoin launchpads. This influence strengthens its current relevance. Yet, consolidation after such gains appears necessary. Sideways trading could help build stability before any continued advance.

Overall, Pump.fun has regained momentum despite deep historical losses. Strong volume, technical breakout, and favorable positioning have created conditions for recovery. Yet, the sharp long-term decline highlights the need for sustained liquidity and demand to validate further growth.