- XRP must close above $0.533 to confirm a falling wedge breakout pattern.

- Whales sold 160M XRP in 14 days, reducing holdings between 10M–100M range.

- Resistance levels at $0.600 and $0.630 could slow XRP’s move to $1.000.

According to EGRAG CRYPTO’s latest chart analysis shared on TradingView, XRP is showing signs of forming a bullish breakout. The token is moving within a falling wedge, a pattern often linked with upward price movements when confirmed.

A breakout confirmation requires a daily close above $0.533. If this happens, analysts expect a potential price surge. Resistance levels to watch include $0.600 and $0.630, while the major target is $1.000. The analysis also mentions a longer-term target of $3.000. These projections are based on measured move calculations from the wedge.

However, the report also includes caution zones. A drop below $0.480 or $0.410 would cancel the bullish setup. “Potential throwbacks” have been marked in red zones, which might test support levels before any further gains. Traders are advised to monitor price actions closely as XRP nears these technical points.

Whale Activity Signals Market Uncertainty

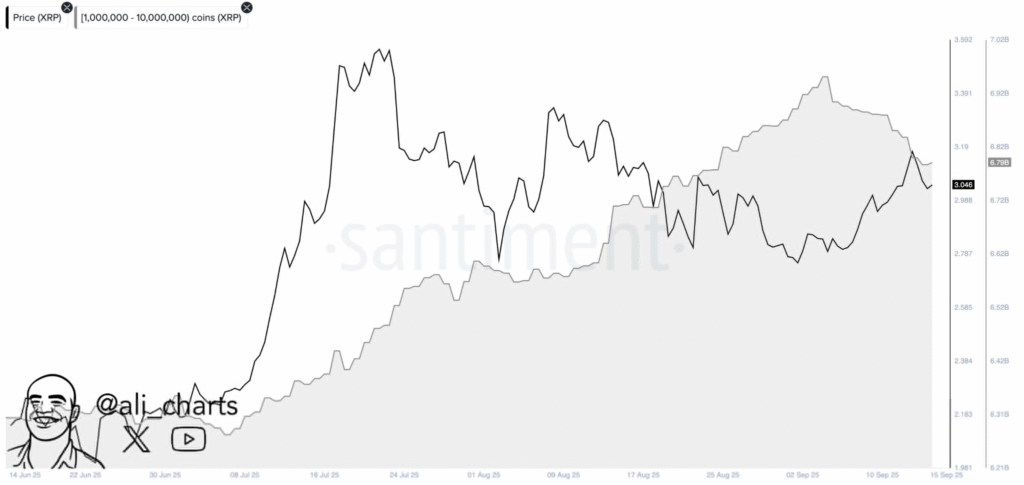

While the chart shows possible bullish patterns, on-chain data tells a different story. Analyst Ali Martinez’s data from Santiment reports that XRP whales holding between 10 million and 100 million tokens sold about 160 million XRP over the past two weeks.

This selloff reflects a drop in whale holdings and the token’s price. The chart shows a correlation, with the gray area representing whale holdings and the black price line both declining.

Although it is not confirmed whether the selling trend will continue, such large movements from whales often influence market conditions. The activity may reflect profit-taking or shifting sentiment among large holders.

This behavior introduces caution into the bullish outlook from the falling wedge. Combined with critical price levels, the selloff puts XRP in a complex position where traders must remain alert.

Price at a Turning Point

XRP’s price movements are currently caught between two forces technical optimism and bearish whale behavior. If XRP holds above the $0.533 level and breaks resistance, a rally might follow.

But with whales actively selling and prices softening, the short-term future remains uncertain. Market watchers are now focused on both charts and on-chain signals as XRP approaches a pivotal point.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.