- Sentiment stretched into FOMC — Crowd greed is high, so upside needs a dovish surprise or strong breadth; otherwise, “sell-the-news” risk dominates.

- BTC map for the headline — Bias is soft below 115.8–116.0k; support sits at 115.2–115.3k, with downside windows to 115.0–114.8k if that shelf fails.

- XRP’s pivot and trigger — Holding above 3.00 keeps the breakout case; a volume-backed break over 3.04 targets 3.06–3.10, while <2.995 weakens the setup.

Crypto markets enter the Fed week with firm expectations and stretched optimism. Bitcoin softens intraday while XRP holds the $3 pivot. Therefore, rate guidance and liquidity conditions will likely steer the next directional move.

Macro Context and Sentiment

Traders widely expect a 25 basis point cut at the FOMC meeting. Social metrics show bullish comments dominate current chatter across platforms. Consequently, a sell-the-news reaction becomes a realistic risk into the announcement.

Analytics data shows 64% positive comments and a 1.77 bullish-to-bearish ratio, the highest in ten weeks. Elevated greed compresses upside surprise rather than timing reversals precisely. Therefore, fresh momentum requires either dovish messaging or broad market participation.

Liquidity often thins near policy events, and small orders move price more than usual. Funding, open interest, and options skew will shape impulse persistence after the decision. Moreover, wide intraday ranges can follow quickly if expectations break.

Bitcoin (BTC)

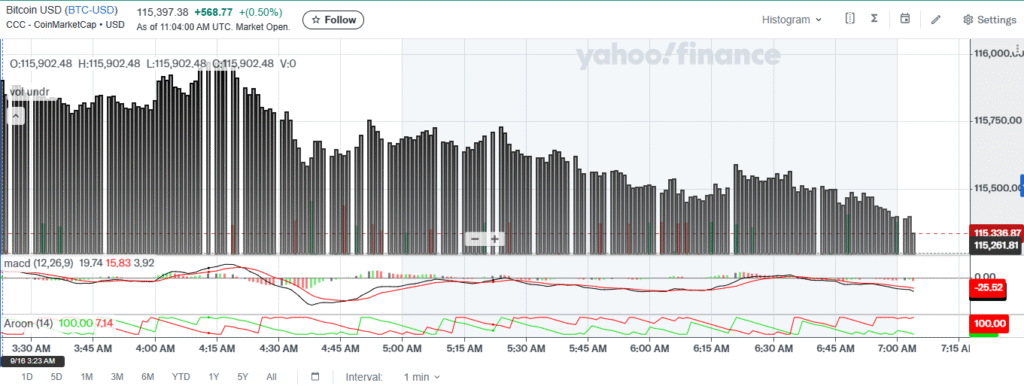

On one-minute charts, BTC pushed toward 115.9k and then faded to 115.3k. Volume rose into the push and then tapered afterward. Thus, price shifted from expansion toward balance during the morning session.

Source: Yahoofinance

Momentum cooled as MACD crossed down toward zero while histogram bars turned small and negative. Aroon Up fell as Aroon Down climbed decisively through the midline. Consequently, recent lows arrived more frequently than highs on this timeframe.

Key support stands near 115.2k to 115.3k after several minor bounces formed. Resistance clusters near 115.6k and 115.8k, then 116.0k overhead. A base above 115.6k and break over 115.8k would realign the trend higher.

XRP

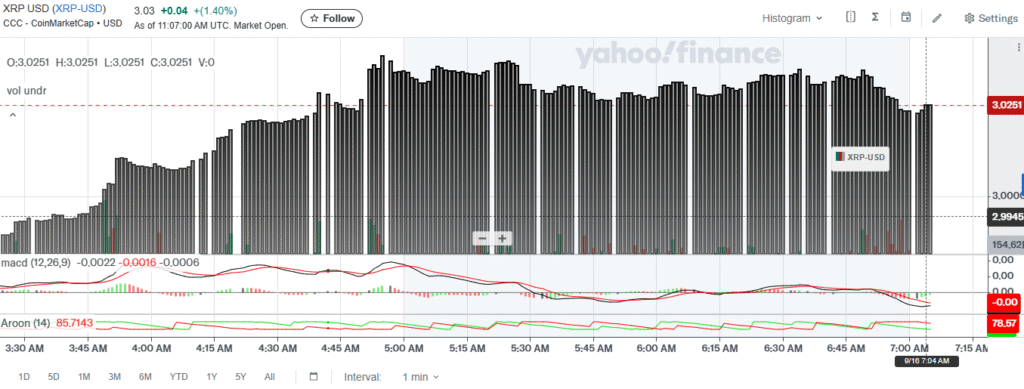

XRP trades in a narrow band above 3.00 after an earlier pop higher. The move followed a multi-year compression and a decisive breakout. Therefore, the 3.00 zone acts as a key pivot for direction.

Short-term momentum shows signs of improvement as MACD curls toward a bullish cross. Aroon Up trends higher while Aroon Down eases toward lower readings. Hence, pressure for another attempt higher is gradually rebuilding.

Source: Yahoofinance

Immediate support sits at 3.01 with invalidation defined below 2.995 on acceptance. A decisive move through 3.04 on rising activity targets 3.06 to 3.10 next. Yet progress will likely be staged as participation broadens and breadth firms.

Overall, sentiment skews optimistic while positioning looks stretched into the decision. If the Fed meets expectations and guidance stays neutral, unwinds could cap immediate upside. However, a softer tone or broader participation could extend gains, while hawkish surprises threaten downside follow-through.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.