- Bitcoin saw volatile price movements on September 17 before Powell’s speech.

- Daan Crypto Trades predicted increased volatility due to Powell’s upcoming remarks.

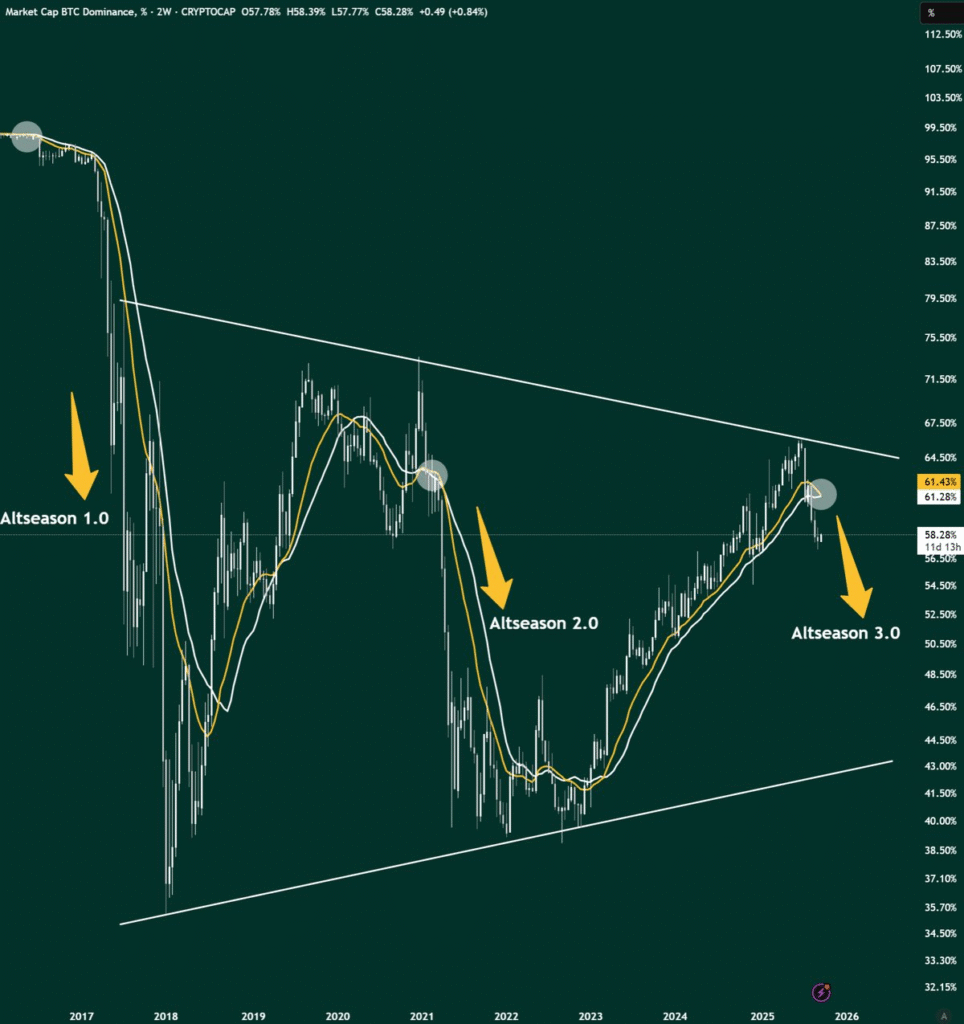

- A Bitcoin dominance death cross pattern suggests a potential altcoin rally.

On September 17, 2025, Bitcoin experienced significant price fluctuations, demonstrating classic volatility. The price rose sharply and then dropped just as dramatically, reflecting the market’s sensitivity to news and economic events.

The sudden moves in Bitcoin’s price came just ahead of Federal Reserve Chairman Jerome Powell’s scheduled speech, which had many traders on edge.

Daan Crypto Trades, a notable crypto analyst, forecasted that Bitcoin would experience heightened volatility in the hour leading up to Powell’s remarks. His prediction was based on the anticipation of Powell’s speech and its potential influence on market sentiment.

In a later tweet, Daan mentioned that Bitcoin was initiating “low timeframe stop hunts,” which typically target overleveraged positions. This suggests that traders were adjusting their positions in response to the upcoming speech.

Bitcoin Dominance Death Cross and Altcoin Rally Predictions

Bitcoin’s market dominance is also under scrutiny, as a rare “death cross” has appeared on the Bitcoin dominance chart (BTC.D). This event has historically indicated a shift in market focus from Bitcoin to altcoins, sparking speculation that an altseason may be underway.

The death cross occurs when two key moving averages on the BTC.D chart intersect, signaling that Bitcoin’s dominance could be decreasing in the short term.

The chart shared by AltcoinGordon, a popular cryptocurrency analyst, highlights that this pattern has preceded every major altseason since 2016. As Bitcoin’s dominance declines, altcoins often see significant rallies.

Bitcoin’s Disruptive Potential in Global Finance

The media also discussed Bitcoin’s ability to transfer large sums without fees or time constraints. Eric Trump recently appeared on Bloomberg, emphasizing Bitcoin’s capacity to transfer $500 million without incurring any fees, even during off-hours like Sunday nights.

He pointed out that this feature concerns traditional financial institutions, which often rely on fees and time restrictions. Analysts have responded by noting how Bitcoin’s low-cost and efficient transfer system challenges traditional banking methods.

With Bitcoin increasingly seen as an alternative to the conventional financial system, its ability to bypass intermediaries could transform the global finance landscape. This growing influence of Bitcoin on financial institutions and markets continues to generate debate among both proponents and critics.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.