- Bitcoin tracks the rise in global M2 money supply, signaling bullish momentum.

- Bitcoin’s critical support level is at $115,440; breaking this could lead to a drop.

- The Federal Reserve’s 25 basis point rate cut boosts liquidity but leaves market uncertain.

Bitcoin’s price has closely mirrored the rise in global liquidity, particularly the M2 money supply. The surge in global liquidity has reached new all-time highs, which has been a crucial factor in Bitcoin’s recent upward trend.

According to Crypto Rover, as the global M2 money supply continues to grow, Bitcoin’s price movement follows suit, suggesting a positive outlook for the cryptocurrency. Analysts point to this correlation as a sign that Bitcoin may experience further bullish momentum, especially given the increasing levels of liquidity in the global market.

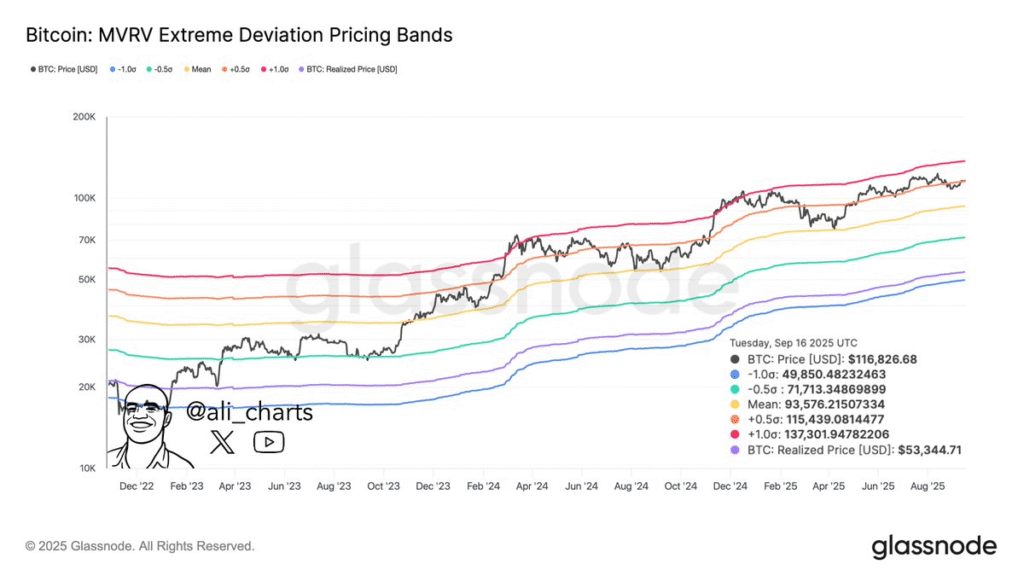

Bitcoin Faces Critical Support Level at $115,440

Meanwhile, data from Glassnode and analyst Ali Martinez reveal that Bitcoin’s critical support level, based on the MVRV Extreme Deviation Pricing Bands, is $115,440. This level is key for Bitcoin’s short-term market stability. Should Bitcoin manage to hold this support, it could potentially move towards the next key level, $137,300.

However, if Bitcoin’s price falls below $115,440, it could drop to the critical support zone around $93,600. As market conditions remain volatile, this support level is crucial in determining Bitcoin’s price direction.

Federal Reserve Cuts Interest Rates by 25 Basis Points

The Federal Reserve recently reduced interest rates by 25 basis points, marking its first rate cut since December 2024. While market participants anticipated this decision, it fell short of expectations. Analysts had hoped for a more substantial 50 basis point cut, which would have provided a clearer signal of economic stimulation.

The market’s response has been mixed. Some view the reduction as a positive move, while others remain cautious. The uncertainty around the Fed’s future actions continues to influence market sentiment, including Bitcoin’s potential movement.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.