- Bitcoin’s MCI remains low, indicating normal market conditions since July.

- Global M2 money supply surpasses $116 trillion, supporting Bitcoin’s rise.

- Rising liquidity continues to correlate with Bitcoin’s upward price trend.

Bitcoin’s Market Capitulation Index (MCI) has been a vital tool for identifying market bottoms and capitulation phases. Recent data suggests the market has been calm since July 2024.

The MCI, which ranges from 0 to 3, monitors three key stress signals: a 30% drop in hash rate over 30 days, a price drawdown greater than 50%, and more than 15% of Bitcoin’s supply becoming active within seven days. Each of these indicators contributes one point to the index. Scores of 2 or higher point to severe market stress or a potential capitulation phase.

Currently, Bitcoin’s MCI remains low, signaling that the market is in a normal state. The MCI score has not reached the critical threshold needed to signal capitulation.

Analysts suggest it may take months before all the conditions required for a true market capitulation are met. According to experts, the alignment of on-chain data, price movements, and mining conditions is necessary for such an event to occur.

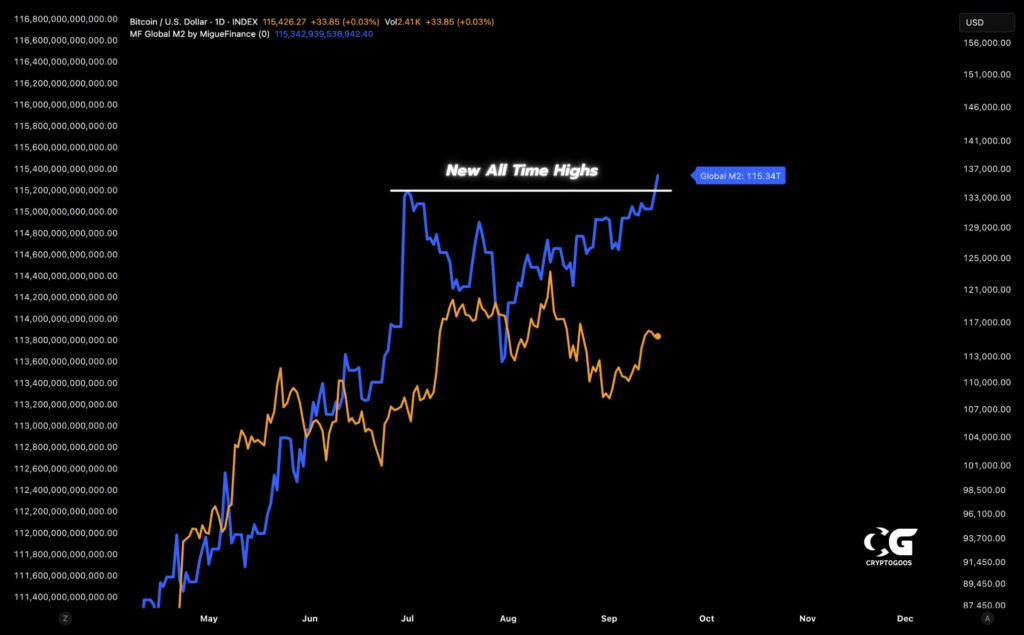

The Surge in Global M2 Liquidity

Global liquidity has been growing significantly, which is seen as a key driver of Bitcoin’s recent price movements. The latest data from CryptoGoos shows that the global M2 money supply has surpassed $116 trillion, a record high.

This increase in liquidity correlates with Bitcoin’s performance. The cryptocurrency has reached new all-time highs as global M2 has been rising sharply. The global M2 money supply tracks the amount of money circulating in the economy, including cash, checking, and savings accounts.

The chart presented by CryptoGoos shows a clear relationship between Bitcoin’s price and the global M2 money supply. When liquidity expands in the global financial system, Bitcoin has historically followed a similar upward trajectory.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.