- The altcoin sector excluding BTC and ETH hit a record high, targeting $1.8T–$2T with strong momentum.

- Total crypto market cap rebounded above $4T as daily inflows crossed $1B on multiple September sessions.

- Open interest climbed past $820B while Ethereum’s volatility nearly doubled Bitcoin’s, signaling intensified risk-taking.

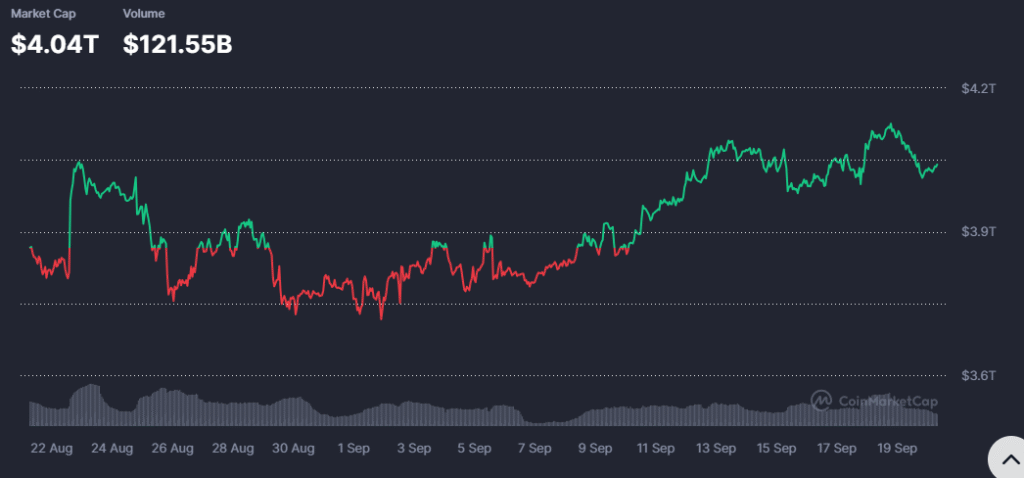

The global cryptocurrency market showed renewed strength this week as liquidity returned and speculation accelerated across major digital assets. Market capitalization crossed $4 trillion while daily volumes exceeded $120 billion. Traders pushed prices higher after a sharp recovery in early September.

Altcoin Sector Hits New Highs

The altcoin market excluding Bitcoin and Ethereum reached an all-time high, confirming renewed participation across smaller tokens. Charts indicate the sector entered a fifth Elliott Wave cycle, with upside potential still in play. Fibonacci extensions suggest targets between $1.8 trillion and $2 trillion in the medium term.

Retracement zones around $600 to $800 billion provide support if prices reverse, highlighting critical technical levels. The recent breakout signals increased appetite for risk outside the two leading coins. Strong flows continue into mid-cap and small-cap assets, which benefit most during speculative phases.

Previous corrective phases showed sharp pullbacks, but current momentum suggests a possible continuation of the upward cycle. Sustained activity in altcoins demonstrates market resilience and confirms that new liquidity is driving expansion. Price action shows the sector remains central to the broader market rally.

Bitcoin Maintains Market Dominance

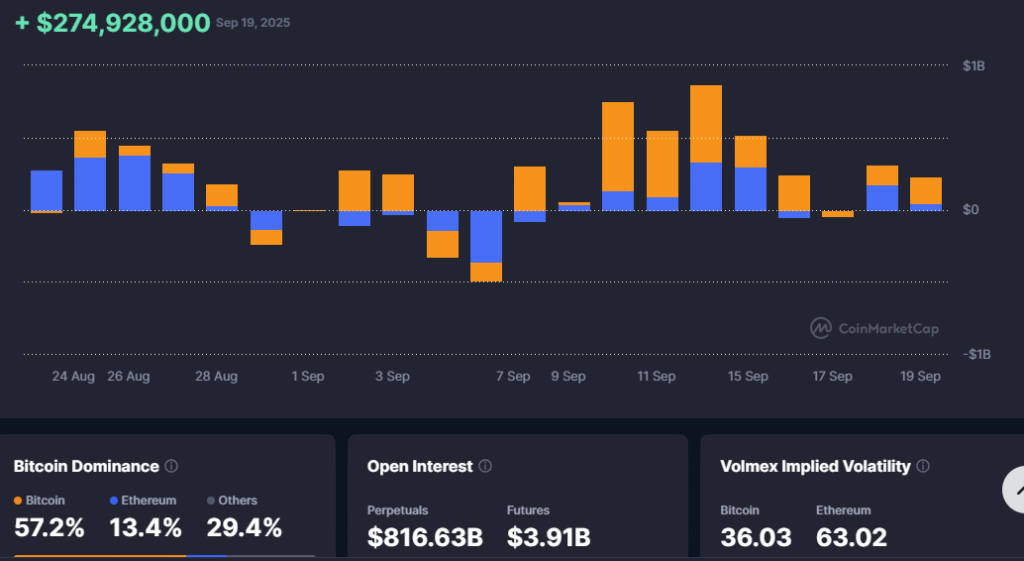

Bitcoin still controlled 57.2 percent of the total market, which indicates its status as the standard asset. Ether had a share of 13.4 percent and other altcoins had 29.4 percent. The balance is an indicator of the gradual capital flow diversification.

Source: coinmarketcap

Daily net inflows highlighted alternating periods of strength and weakness, yet overall activity trended positive since mid-September. Inflows above $1 billion occurred on multiple days, reinforcing upward pressure. September 19 still showed a net positive figure of $274 million, extending the positive streak.

Despite recent volatility, Bitcoin’s role as the primary driver of sentiment remains clear. Ethereum’s lower dominance reflects limited gains relative to Bitcoin, while smaller altcoins attracted a rising share. The distribution confirms that liquidity is spreading more evenly across the sector.

Derivatives Activity and Volatility

The derivatives interest rose open and was valued at perpetual contracts and exchange of futures of 816.6 billion and 3.9 billion respectively. The speculative involvement in the retail and institutional sectors is also increased at this level. Powerful leverage positions enhanced the latest actions, prompting short-term volatility.

Source: coinmarketcap

Implied volatility helped to identify major distinctions between assets, as Bitcoin and Ethereum stood at 36.03 and 63.02. The greater number of Ethereum means more drastic anticipated volatilities, which are consistent with the recent trend in its price. This deviation highlights more risk-taking of altcoins than that of Bitcoin.

Generally, the market recovered its strength as it recovered liquidity that increased its total capitalization to more than $4 trillion. Both intense inflows, increasing derivatives trading, and increased volatility indicate that speculation is the main driver of prices.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.