- AVAX retraces to key demand zones at $29.8–$30.5 and $28.0–$28.8, with $28 as invalidation.

- The $33–$34 range blocks recovery, keeping AVAX constrained unless bulls reclaim $32–$33 with conviction.

- KDJ indicators trend lower, signaling fading strength and potential for continued consolidation within the $28.30–$31.00 range.

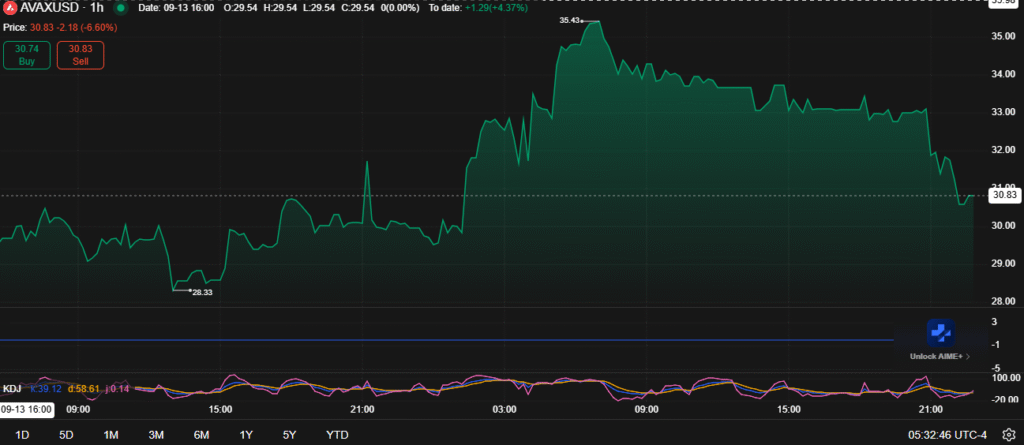

AVAX retraced significantly after hitting a recent high of $35.43, closing the latest session near $30.83 with a 6.60 percent drop. The rejection around the mid-$35 zone indicated strong selling pressure that disrupted upward momentum. This shift highlighted a turning point in the short-term structure.

Price action revealed clear volatility as the token cooled following the sharp surge earlier this month. The retracement moved the market back into critical demand zones. This decline also reflected profit-taking activity after an extended push higher.

AVAX now sits near levels where historical accumulation has supported rebounds. These include $29.8 to $30.5 as the first checkpoint and $28.0 to $28.8 as the second. These zones will likely determine near-term direction.

Key Support and Resistance Levels

The $28.33 support level emerged earlier as a pivotal base before the rally. This price acted as a springboard for the surge to $35.43. Maintaining this base now appears critical to preserving bullish momentum.

Source: chart.ainvest

Resistance has developed at $33 to $34, where repeated attempts to advance failed. This zone continues to cap upward movement, leaving bulls struggling to break through. Without a clear close above, recovery remains restricted.

The invalidation point stands at $28, which if breached would weaken the technical structure. A close below would likely confirm deeper downside potential. This marks the most decisive boundary in the current setup.

Technical Indicators and Market Outlook

Momentum indicators reflect fading strength as shown by the KDJ lines trending downward. Both %K and %D suggest limited short-term energy. This signals potential for more consolidation.

The broader range of interest now spans $28.30 to $31.00. This band may stabilize activity if buying pressure sustains. Yet, pressure persists as selling continues to dominate.

For recovery, AVAX must reclaim $32 to $33 decisively. Doing so would restore upward potential and reopen a path toward $35. Until then, the market outlook remains tilted toward consolidation with a downside bias.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.