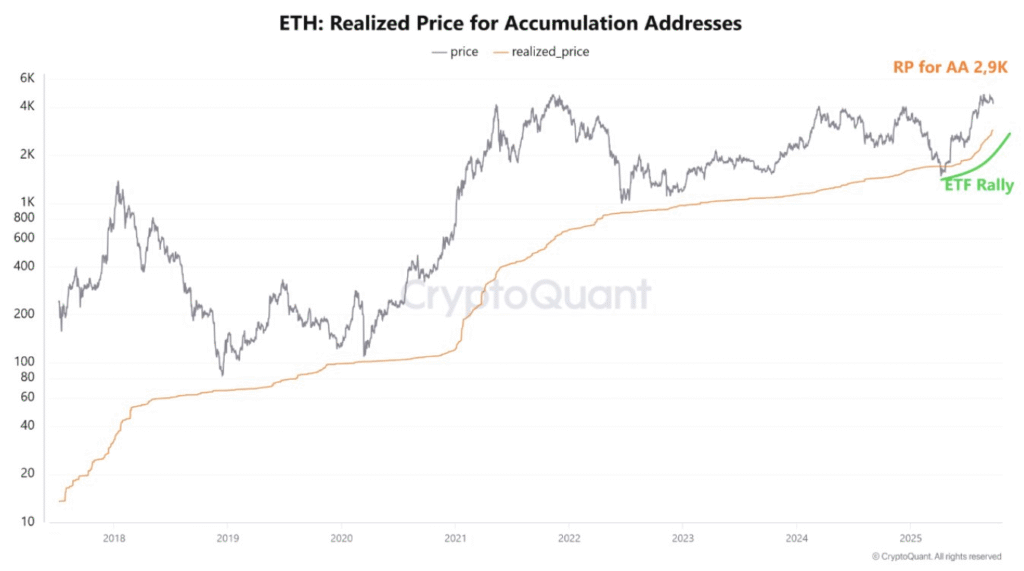

- Ethereum’s accumulation addresses hold a realized price of $2.9K, signaling strong support.

- The ETF rally pushed Ethereum’s price surge, with accumulation addresses holding 27.6 million ETH.

- Ethereum’s price is finding support at $2.9K as accumulation addresses continue growing.

Ethereum (ETH) has shown a notable shift in its accumulation addresses, with the realized price now standing at $2.9K. This price level marks a critical support zone for ETH.

According to data from CryptoQuant, the realized price for these addresses has surged sharply over time, increasing from $1.7K to $2.9K.

This change can be attributed to the recent Ethereum ETF rally, which has contributed to significant price movements. Ethereum’s total balance in these accumulation addresses now stands at 27.6 million ETH, further highlighting the increasing accumulation trend.

Ethereum ETF Rally and the $2.9K Realized Price

The Ethereum ETF rally has played a pivotal role in this price surge. The rally led to a marked rise in ETH’s value and also contributed to the growth of accumulation addresses.

The rise from $1.7K to $2.9K in the realized price indicates that these addresses are being actively accumulated, reinforcing the idea of $2.9K as a key support level. This development suggests that traders are positioning themselves around this level, seeing it as a critical point for Ethereum’s future price movements.

Growing Accumulation Trend Signals Support at $2.9K

Ethereum’s growing accumulation trend is evident in the rising balance within these addresses. With a total of 27.6 million ETH now stored in these addresses, it is clear that there is substantial support at the $2.9K price level.

The increase in accumulation aligns with the sharp price surge, reinforcing the idea that Ethereum could maintain this support zone for the foreseeable future. The significant number of ETH stored in these accumulation addresses further indicates strong confidence in the asset, especially as the price hovers around the $2.9K mark.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.