- Long-term Bitcoin holders have realized $120 million in profits amid BTC’s price surge.

- Selling pressure from 6–12 month Bitcoin holders adds headwinds to BTC’s price.

- Bitcoin’s current support at $111,400 is critical for future price direction.

Bitcoin ($BTC) long-term holders have locked in a significant $120 million in realized profits as of September 21, 2025. This surge in profits coincided with Bitcoin’s price reaching a high of $115,270 per BTC.

These long-term holders, typically considered more patient investors, have capitalized on the recent bullish market trend. The realized profits peaked between September 8 and September 21, highlighting the strategic positioning of Bitcoin’s most significant stakeholders.

The data suggests that long-term holders are acting based on market trends, choosing to take profits while Bitcoin’s price is experiencing strong upward momentum.

As Bitcoin continues to fluctuate in the market, this period has presented an opportunity for these holders to realize substantial returns. The profit locked by these holders, amounting to $120.133 million, signals that whales are strategically capitalizing on the price momentum.

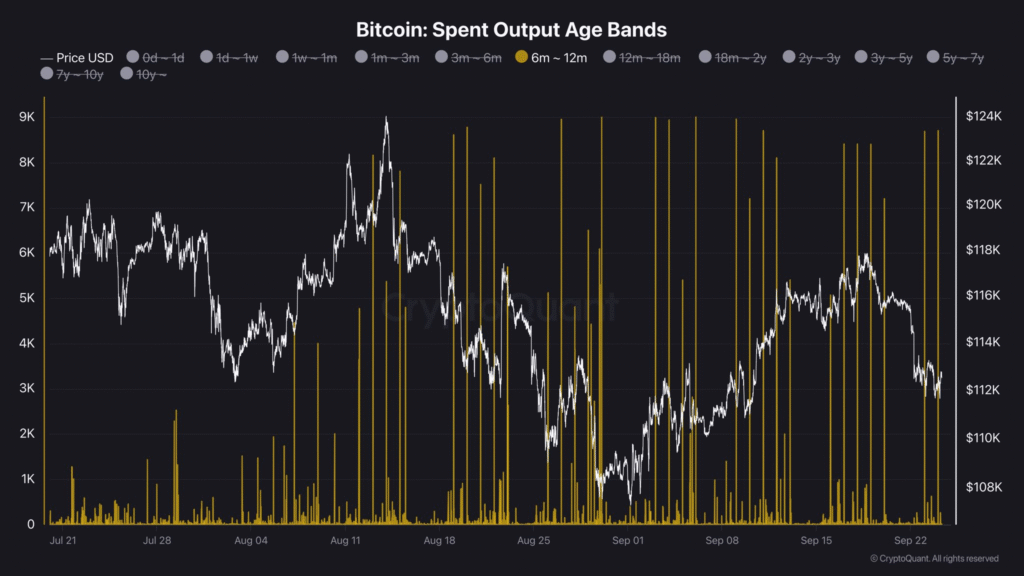

Selling Pressure from 6–12 Month Holders

In contrast to the gains realized by long-term holders, recent data from Darkfrost reveals that Bitcoin holders who have held their assets for 6 to 12 months have been actively selling. As seen in the chart, yellow spikes indicate frequent outflows from this group of holders.

While it’s unclear whether this selling pressure is driven by a single entity or a broader trend, the consistent outflows are evident, contributing to a headwind for Bitcoin’s price in the market.

This selling behavior is significant as long-term holders control a substantial portion of Bitcoin’s total supply, with estimates ranging from 80% to 85%.

As these major stakeholders move their assets, notable market shifts are created. While the exact reasons behind this selling are unclear, it signals a change in sentiment among some of Bitcoin’s most influential participants.

Bitcoin Testing Critical Support Levels

Bitcoin’s price is currently testing critical support levels after experiencing a pullback from its recent highs near $113,000. The price has found support around $111,400, a key level that market participants are watching closely.

If Bitcoin fails to maintain this support, it could signal further downside movement towards the $109,500 to $108,000 region.

However, if the support holds, there is potential for a bounce that could lead Bitcoin back to retest the upper trendline near $116,000. The market’s reaction at this support level will be crucial in determining the direction of Bitcoin’s price in the near term.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.