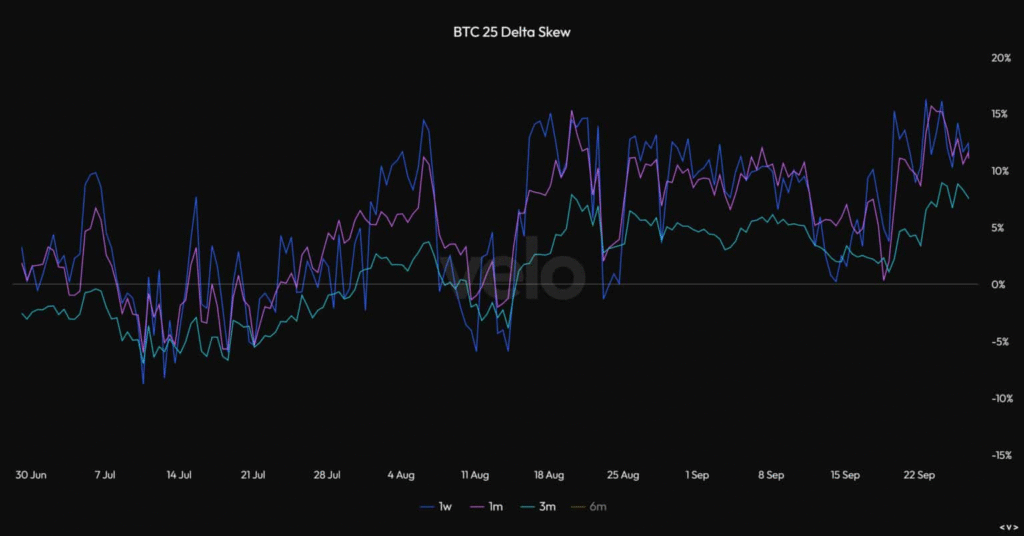

- Bitcoin 25-Delta Skew shows more short-term hedging ahead of shutdown.

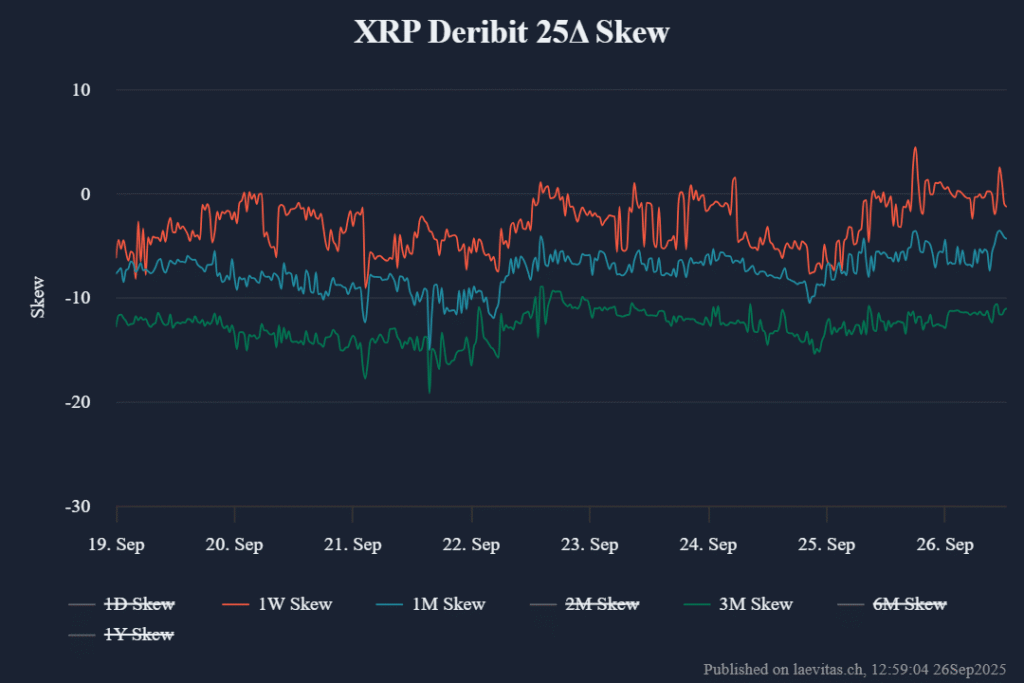

- XRP’s market sentiment remains neutral to negative across all tenors.

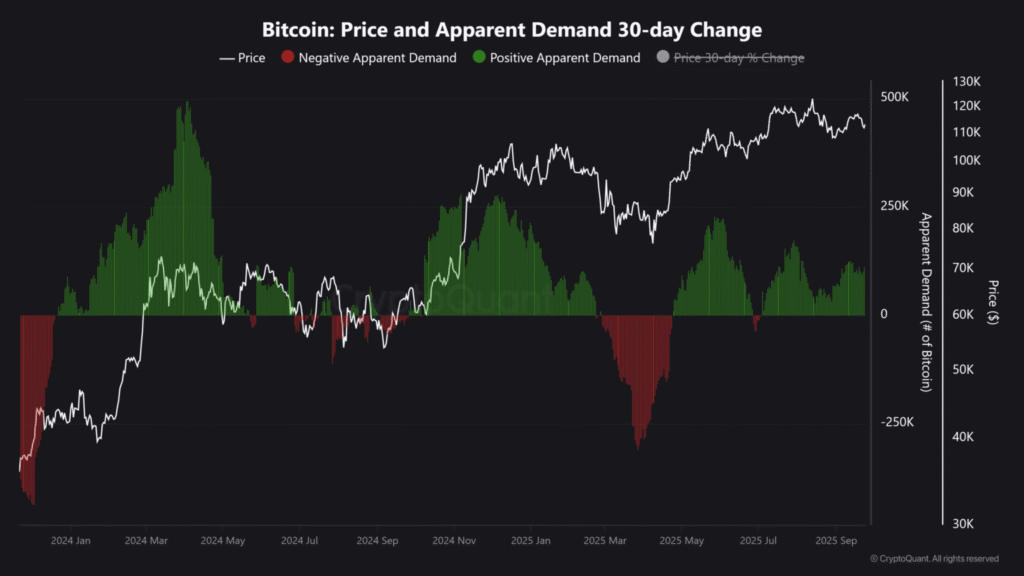

- Bitcoin’s demand remains strong despite the looming government shutdown.

As the U.S. government shutdown approaches on October 1, uncertainty grows over its impact on financial markets, including cryptocurrencies. Congress’s failure to set government funding plans has raised the likelihood of a shutdown, which could last for at least a week.

On September 25, Bitcoin and other major cryptocurrencies, including XRP, saw price declines, reflecting a broader sense of caution in the market. The overall sentiment suggests that altcoins could face greater challenges in the short-term than Bitcoin.

Bitcoin’s Short-Term Market Sentiment

Bitcoin’s 25-Delta Skew has shown a marked decrease, particularly in the 1-week (blue) and 1-month (purple) tenors. This suggests that traders are taking more bearish positions or hedging against further downside risks.

The data indicate an increase in demand for put options, reflecting heightened caution due to the looming government shutdown and other macroeconomic factors. However, the 3-month tenor has remained relatively stable, suggesting that traders still hold a more optimistic view on Bitcoin’s mid-term prospects.

Despite the short-term market turbulence, Bitcoin continues to see strong demand. According to recent data, the apparent demand for Bitcoin surged in September.

While the demand has plateaued recently, it has not seen a sharp drop, indicating that institutional interest remains steady. If this trend continues into Q4, Bitcoin could still experience a recovery, although the extent of the potential rebound remains uncertain.

XRP’s Struggle Amidst Growing BTC Dominance

XRP, however, is facing a different set of challenges. The market sentiment for XRP is neutral to negative across all tenors, including the short-term (1-day, 1-week) and longer-term outlooks. This stands in contrast to Bitcoin, where mid-term sentiment remains more positive.

XRP’s current trajectory suggests that the altcoin may struggle more than Bitcoin, especially if Bitcoin dominance continues to rise in Q4. As of now, Bitcoin dominance has recovered by 4% towards 60%, and this shift could further dampen the momentum for altcoins like XRP.

The potential approval of altcoin ETFs in October may provide some relief, but it remains to be seen whether it will lead to a “sell-the-news” event. The government shutdown adds another layer of uncertainty for altcoin investors, making XRP’s outlook less favorable compared to Bitcoin’s more stable position.

If the shutdown continues to weigh on broader market sentiment, XRP could see further declines, especially as institutional demand for the altcoin lags behind that of Bitcoin.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.