- Bitcoin holds above $100K with stable momentum, as MVRV Z-Score shows no signs of overheating.

- Sustained price growth and cooling ratios highlight a healthier, long-term market structure.

- Institutional flows and ETFs reshape Bitcoin’s valuation dynamics compared to past retail-driven peaks.

Bitcoin continues to trade above $100,000, but key valuation signals show the market remains far from overheated. Recent data highlights stable momentum, with the MVRV Z-Score holding moderate levels despite the strong rally. Analysts see this as a sign of a healthier structure compared to past cycles.

MVRV Z-Score Shows Moderate Pressure

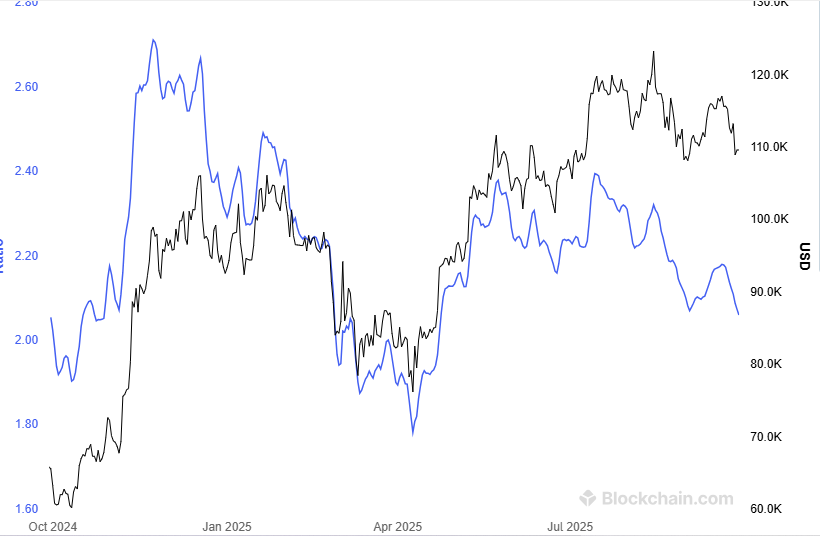

The MVRV Z-Score has historically pointed to market peaks, but current readings suggest less extreme pressure. This metric compares market value with realized value, showing how far prices stretch above cost bases. Presently, the indicator sits at levels aligned with stability rather than excess.

Historically, sharp spikes in the Z-Score have matched cycle tops, including in 2013, 2017, and 2021. Today, Bitcoin’s gradual climb has kept the indicator in a balanced range. This suggests room for further gains before conditions turn overheated.

The steady performance reflects how the market structure has matured. A slower price climb helps maintain healthy sentiment while reducing bubble risks. Unlike earlier cycles, Bitcoin now shows less extreme speculation in valuation signals.

Recent Trends Highlight Sustainable Growth

Data from late 2024 through 2025 shows Bitcoin’s price climbing above $120,000 while the raw MVRV ratio declined. The ratio now trends near 2.0, reflecting more sustainable conditions. This divergence shows fewer holders sitting on excessive profits.

Source: blockchain.com

When fewer profits dominate, markets often hold momentum longer. This is because profit-taking pressure reduces, while demand sustains price stability. Current figures support this dynamic across the latest Bitcoin rally.

The combination of price strength and cooling ratios signals resilience. Instead of forming a sharp top, Bitcoin sustains elevated levels with broader participation. That structure supports long-term market health.

Changing Market Dynamics Shape Valuation

The role of ETFs and institutional participation has reshaped market behavior. These factors spread ownership and influence valuation signals differently than in past cycles. As a result, market indicators now capture broader structural changes.

Unlike retail-driven peaks, today’s flows come from larger and steadier capital sources. This dynamic shifts the weight of traditional valuation tools. The MVRV still guides but must adjust for evolving demand bases.

Overall, Bitcoin’s rally above $100,000 remains solid but not overheated. Indicators confirm a healthier balance between price levels and underlying value. Market participants continue to watch these shifts as the cycle unfolds.