- XRP’s delta has dropped to -200%, signaling heavy selling pressure in the market.

- Major firms, including Bitwise and Grayscale, have filed XRP ETF products with the SEC.

- XRP is showing a bullish trend despite the low buy orders and high selling pressure.

The XRP market has recently witnessed a sharp downturn, as revealed in the September 30, 2025, update from EGRAG Crypto. The market saw XRP’s delta fall to a staggering -200%, with buy orders at an all-time low of zero.

This drop has triggered concerns, signaling that the market could be facing intense manipulation and substantial selling pressure. The absence of buy activity, even at minimal volumes, is being seen as a sign of serious market stress.

EGRAG Crypto, a prominent analyst known for providing insights into lower time-frame (LTF) charts, highlighted this anomaly. “This is something we’ve never seen before,” said the analyst, expressing disbelief at the market’s behavior.

XRP Price Movement and Key Technical Indicators

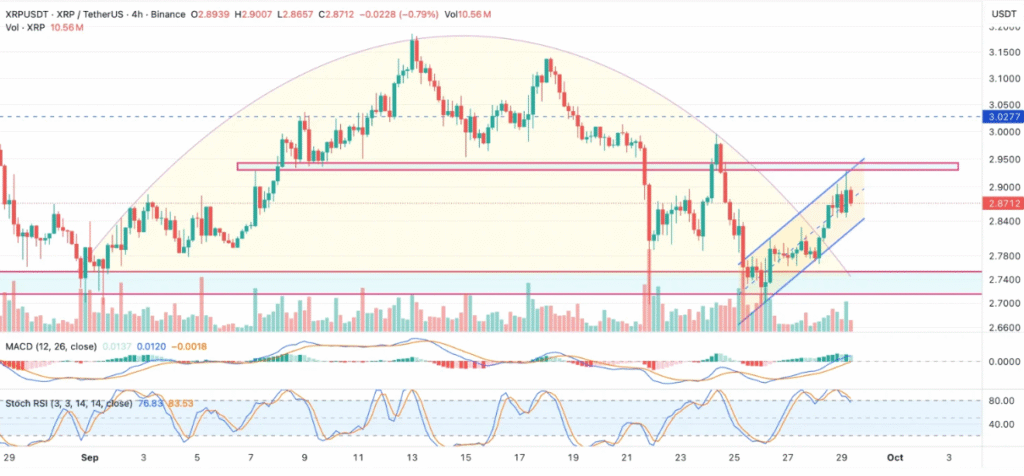

Meanwhile, on the XRP 4-hour chart, the price is currently trading at $2.87, showing signs of a bullish trend. XRP is currently moving within an ascending channel, a pattern often associated with upward price action. The price is nearing key resistance at $2.90, and if it breaks this level, the next target is $3.03.

The MACD indicator is in positive territory, supporting the current bullish momentum. However, the Stochastic RSI is at 83.53, suggesting that XRP may soon enter overbought conditions.

Despite the bearish pressure from low buy orders, the price has maintained its upward movement for now. Support levels are identified at $2.80 and $2.74, which traders will watch closely for any signs of a reversal.

XRP’s ETF Filings Gain Traction on Wall Street

XRP is gaining attention as several firms have filed ETF products with the U.S. Securities and Exchange Commission (SEC). Among the key players, Bitwise has filed its $5B Bitwise XRP ETF, while Grayscale and WisdomTree have also submitted applications.

Grayscale’s XRP ETF holds $40B in assets under management (AUM), and WisdomTree’s filing is valued at a significant $113B. These filings are seen as a sign of growing institutional interest in XRP. The movement is being closely watched by market analysts, who believe that XRP could potentially replicate Bitcoin’s success.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions..