- XRP’s prolonged consolidation below all-time highs suggests momentum is accumulating for a decisive move.

- Historical peaks and corrections confirm XRP’s ability to stabilize and rebound despite volatility and external challenges.

- Ripple’s progress in regulatory battles and ecosystem growth strengthens sentiment, supporting XRP’s long-term market position.

XRP has maintained a tight consolidation range for nearly 300 days below its previous all-time high. This period reflects a critical phase where market strength accumulates and volatility compresses. Technical signals suggest the token is preparing for a significant directional move.

Consolidation of this length often precedes sharp breakouts, and the price action reflects balanced supply and demand. The chart shows price stability close to resistance levels rather than weakness. Such behavior increases the probability of a breakout in the near term.

Market activity during this phase highlights resilience despite external pressures. XRP has preserved momentum and avoided steep breakdowns, reinforcing the outlook for potential strength.

Historical Patterns and Market Cycles

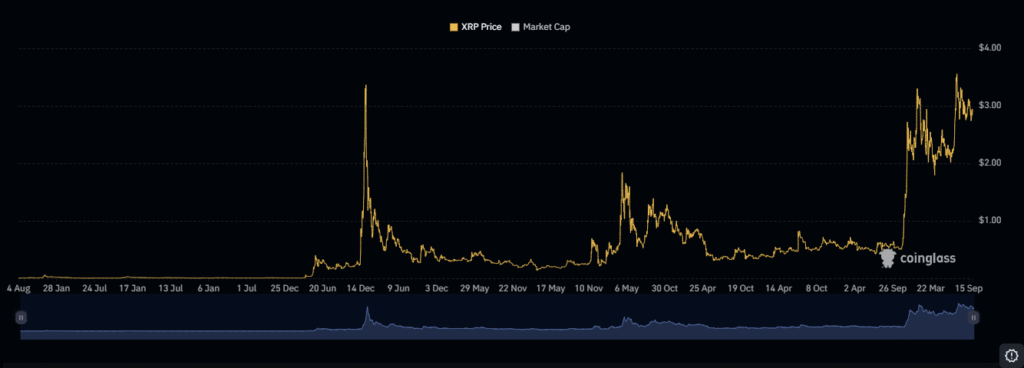

The long-term chart reveals sharp peaks above $3.50 to $4.00 during previous market cycles. These surges were consistently followed by heavy corrections, creating prolonged periods of retracement. Despite volatility, XRP has repeatedly managed to stabilize after each major decline.

Source: Coinglass

This recurring pattern demonstrates its capacity to withstand extended downturns. Market cycles show the asset often rebounds after consolidations, forming a repeating structure across years. Ripple’s ongoing ecosystem development has also contributed to maintaining relevance during quiet phases.

The historical data confirms XRP’s ability to reestablish higher bases over time. Its recovery phases illustrate adaptability despite broader regulatory and sentiment challenges.

Recent Trends and Outlook

In recent months, XRP broke past the $2.00 resistance and stabilized between $2.50 and $3.00. This level now acts as a strong support zone. Price consolidation at higher ranges suggests renewed market confidence and potential for additional gains.

Ripple’s progress in legal battles has supported positive sentiment. Combined with broader utility discussions, these developments created an environment for stronger market positioning. Technical structure supports a continuation of the upward cycle if favorable conditions persist.

Overall, XRP’s price behavior highlights both historical volatility and present consolidation. The asset remains positioned for significant movement, with upcoming cycles likely shaping its long-term direction.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.