- Chainlink’s network added 1,963 new addresses in September, signaling increased adoption.

- Plasma integrated Chainlink’s services, attracting $5.5B in stablecoin supply in one week.

- Aave on Plasma now holds over $6.2B in deposits, benefiting from Chainlink’s data solutions.

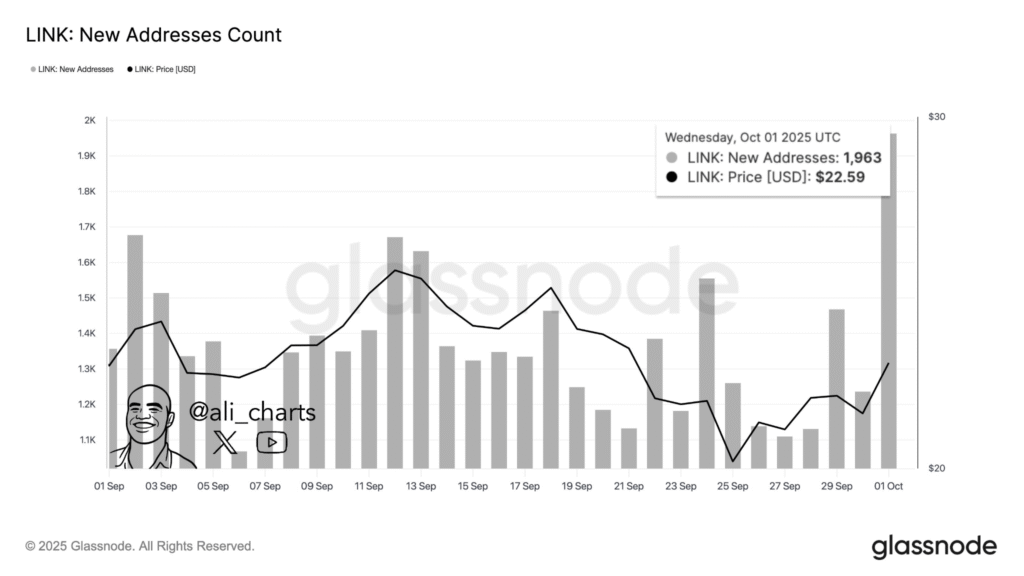

Chainlink has been showing consistent growth, with an increase of 1,963 new addresses in its network throughout September. Ali Martinez’s data from Glassnode show this surge aligns with a gradual rise in LINK’s price, which reached $22.59 on the same day.

The graph shows steady new address activity over the month, with noticeable spikes in the first week and at the end of September.

However, an increase in new addresses indicates that more individuals and projects are actively engaging with Chainlink. As its decentralized oracle network gains traction, it could pave the way for broader adoption across various sectors.

At press time, LINK is priced at $22.24, showing a slight dip of 1.28% in the last 24 hours. Despite the minor dip, the general upward trend reflects the overall positive sentiment around Chainlink’s long-term prospects.

Plasma Joins Chainlink Scale to Enhance Ecosystem

Meanwhile, Plasma, a high-performance layer-1 blockchain built for stablecoins, has joined the Chainlink Scale program. The collaboration aims to boost Plasma’s stablecoin ecosystem, providing secure and efficient solutions for developers.

Plasma has already achieved over $5.5 billion in stablecoin supply within just one week of its launch, with Chainlink acting as the official oracle provider.

Plasma integrates Chainlink’s Cross-Chain Interoperability Protocol (CCIP), Data Streams, and Data Feeds from day one. These services provide reliable, real-time data that enhances the security and functionality of the platform.

By leveraging Chainlink’s robust oracle network, Plasma is positioned to foster the next generation of stablecoin applications. Aave, now live on Plasma, has seen impressive results, attracting over $6.2 billion in deposits.

This collaboration is expected to drive further innovation in stablecoin applications, with both platforms working to support new use cases and advancements in decentralized finance (DeFi).

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.