- Ethereum sees $233M inflow, led by BlackRock’s $206M investment in ETFs.

- Ethereum’s price tests key resistance at $4,750, potentially reaching ATH.

- Key support levels are $4,100 to $4,200, with $3,940 as a fallback zone.

Ethereum ($ETH) remains strong in the market, trading near $4,500 with robust institutional support. The cryptocurrency is currently approaching key resistance at $4,750, with analysts anticipating that a breakout above this level could lead Ethereum toward its all-time high (ATH).

However, as Ethereum faces increased attention from both retail and institutional investors, its performance will be closely linked to its ability to maintain support levels and break through the resistance.

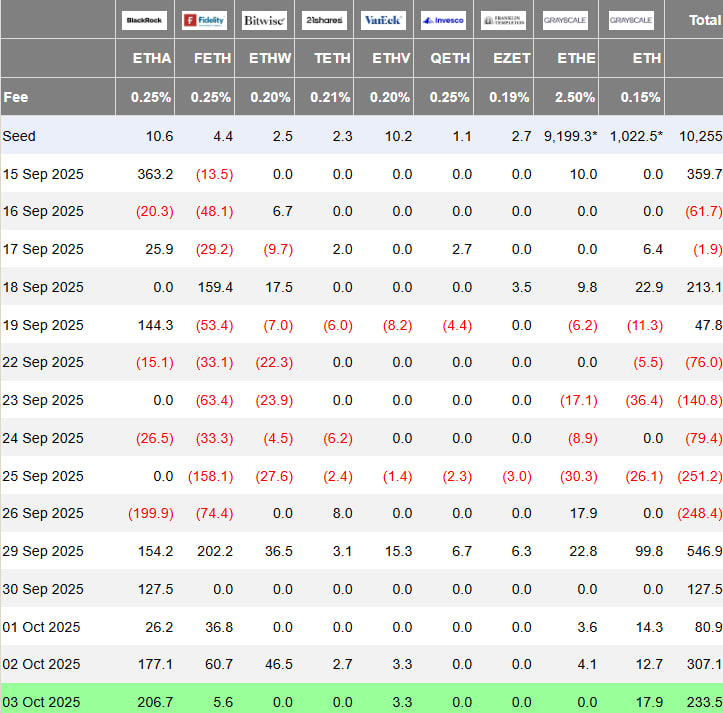

Ethereum ETF Inflows and Institutional Buying Trends

Meanwhile, Ethereum has recently experienced a major influx of capital, as $233M flowed into its ETF market, and BlackRock also purchased a large portion of this amount, $206M.

The shift highlights a growing institutional interest in Ethereum, reinforcing its position as a dominant player in the cryptocurrency market. This influx is part of a broader trend of institutional adoption of crypto assets, signaling greater confidence in Ethereum’s long-term potential.

As these funds pour into the market, it is clear that Ethereum’s role in institutional portfolios is growing. The total ETF inflows indicate a diverse group of investors, with BlackRock making the largest individual purchase.

Ethereum Price Movement and Support Levels

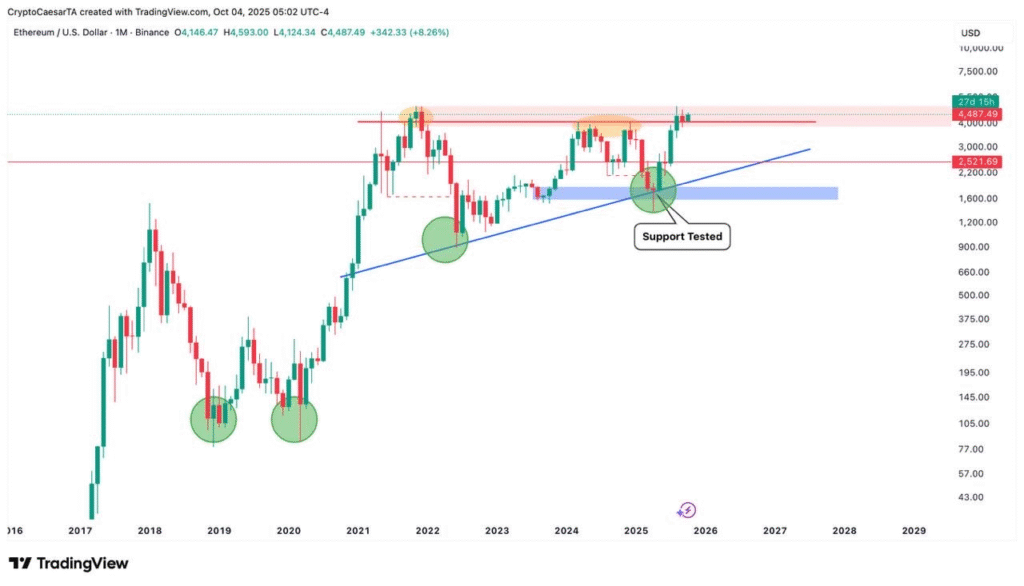

Ethereum’s recent price action has shown significant growth, breaking key levels after testing support at $2,200 earlier this year. The latest chart indicates that Ethereum is now trading at approximately $4,487, having surged from previous support levels.

Analysts have identified $4,500 to $4,700 as the next crucial resistance zones for Ethereum. If Ethereum can successfully breach these levels, there is a potential for further upward movement, possibly targeting $5,000 or beyond.

However, if the price fails to break resistance, traders will be watching key support zones between $4,100 and $4,200. Additional support exists at lower levels, such as $3,940, $3,870, and $3,740.

This ongoing uptrend shows that Ethereum is testing new highs after a solid period of consolidation. The trendline shows that if the price holds support at current levels, Ethereum’s market outlook remains strong.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.