- Solana ($SOL) could revisit $210 before aiming for a new all-time high.

- Bitwise’s Matt Hougan sees Solana as Wall Street’s preferred blockchain.

- Ethereum dominates stablecoin market, but Solana’s growth remains strong.

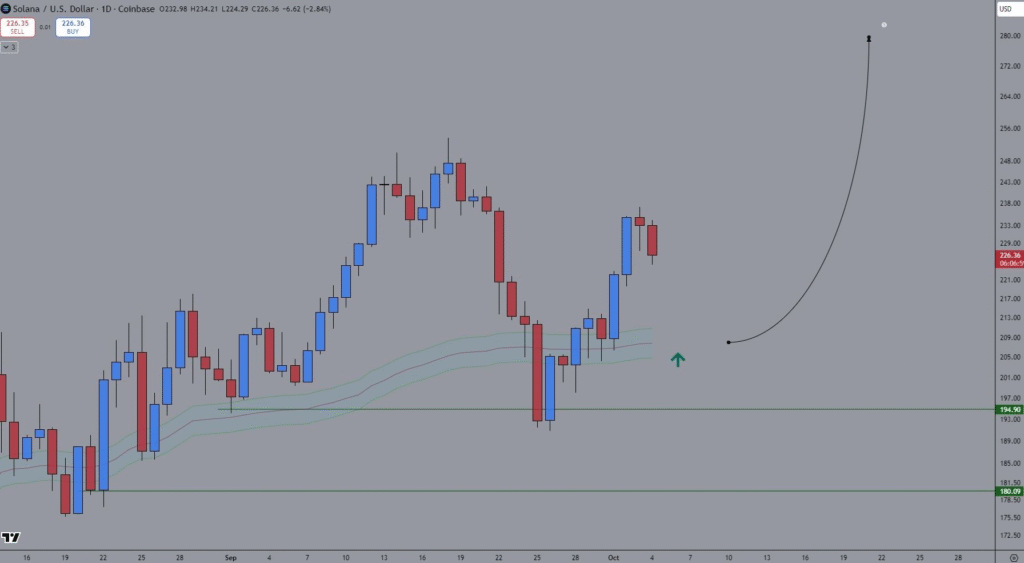

Solana ($SOL) might experience a pullback to the $210 range before advancing toward new all-time highs. This potential dip could offer a buying opportunity for traders as the cryptocurrency market continues its recovery. While the price may temporarily retreat, experts suggest that a strong upward momentum could follow, pushing Solana to new heights in the near future.

Pullback and Potential for ATH

Solana’s price trend has been showing signs of revisiting the $210 price zone. According to technical analysis, this pullback is likely to be brief before the cryptocurrency begins its ascent toward a new all-time high (ATH).

As market conditions improve, Solana’s bullish momentum could push its price beyond previous peaks, creating an ideal opportunity for investors to position themselves. The cryptocurrency market has shown encouraging signs of recovery, and many analysts expect that Solana could lead the charge in the coming months.

Traders are advised to remain vigilant for market movements and prepare for potential buying opportunities that may arise as Solana approaches the $210 support level. A strong rebound could provide a significant entry point for those looking to capitalize on Solana’s anticipated growth.

Solana as a Preferred Network for Stablecoins

Matt Hougan, Chief Investment Officer at Bitwise, has predicted that Solana will become the preferred blockchain for stablecoins and tokenization in the future. Speaking on October 2, Hougan emphasized Solana’s advantages in terms of speed, throughput, and finality, noting that these qualities make the blockchain attractive to institutional investors.

He explained that Wall Street sees the potential of stablecoins and tokenization to revolutionize payments and financial markets. Hougan mentioned that Solana’s impressive speed improvement from 400 microseconds to 150 microseconds for settlement aligns with the needs of institutional investors who prioritize fast and efficient transactions.

This could make Solana a key player in the tokenization of real-world assets, including stocks, bonds, commodities, and real estate. While Ethereum remains the dominant blockchain for stablecoin transactions, Solana’s growth in this sector is notable, with $13.9 billion in stablecoin value currently on the platform.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.