- Chainlink breaks lower time frame trendline, indicating cooling momentum.

- $20-$20.5 zone shows potential for a bounce in Chainlink price.

- A deeper correction could lead to a price drop to $17-$18 zone.

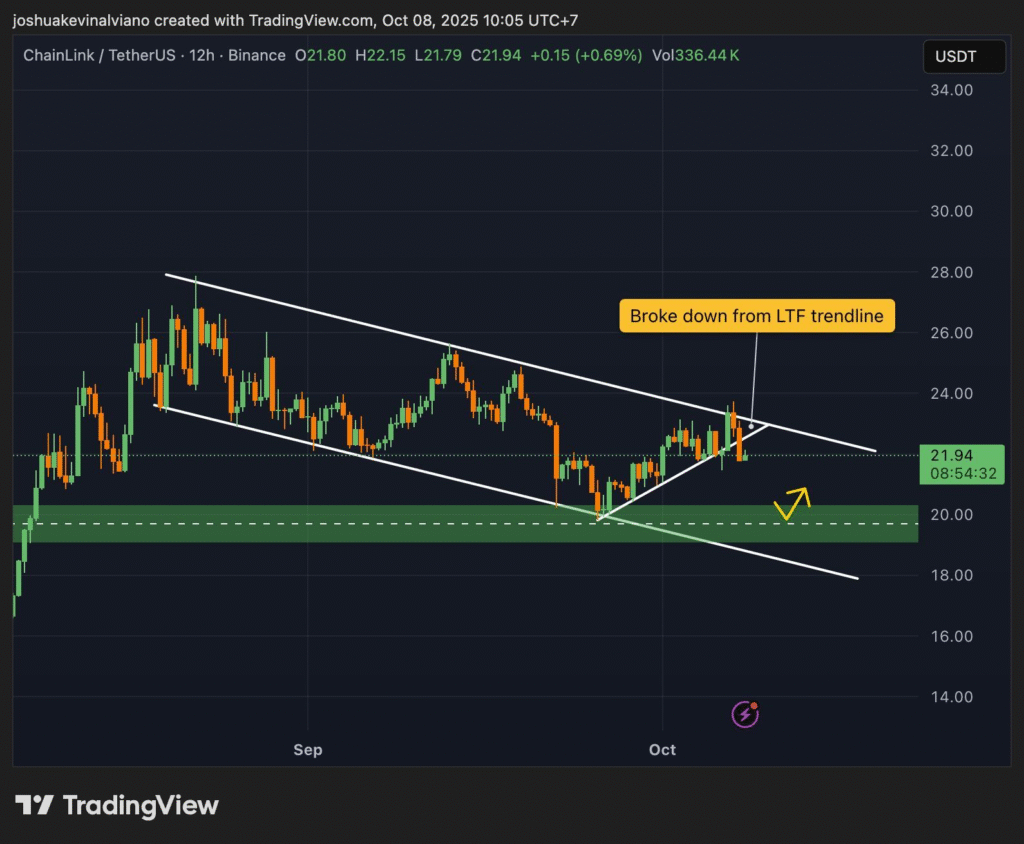

Chainlink (LINK) is losing momentum after breaking down from its recent lower time frame trendline. This breakdown suggests that the price may experience further downside in the short term. Traders are now looking at two key support zones that could be the bounce.

Breakdown from the Trendline Signals Cooling Momentum

Chainlink price broke below the trendline and that means bullish momentum is cooling off. After a strong move up, the breakdown means a short term correction is underway. With this trendline break, the price action can now test lower support levels.

According to the chart analysis, the first support zone to watch is between $20 and $20.5. If the price reaches that level, it could bounce as buyers enter the market. This zone is critical as it’s the first point of price stabilization. If it fails to hold, it could indicate a deeper correction and a test of lower support levels.

Support Zones: $20-$20.5 and $17-$18

If the price fails to hold the first support zone, attention will shift to the second zone which is between $17-$18. This is additional level of assistance and may be a better basis to make a turnaround in case the correction advances.

Despite the breakdown, the overall structure of Chainlink is still healthy. The challenge for the bulls now is to defend these support zones and keep the upward potential for the next move. If the price stays within these zones, a recovery to the previous highs is possible.

Traders are watching closely how the market reacts at these support levels, a bounce could mean another leg up. However, if the support zones fail, further downside is likely. As with any market, we need to monitor to see if this is a pullback or a sign of a longer term downtrend.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.