- ZCash dropped 17% in 24 hours but remains 54% higher week-on-week.

- Over $16M in short leverage could trigger a short squeeze if ZEC rises.

- Technicals suggest a bull flag pattern, with resistance near $255.

ZCash (ZEC) has lost 17% in the last 24 hours, falling from recent highs near $249. Despite the correction, the privacy-focused coin still shows a 54% weekly gain. Analysts note that the broader trend remains positive, with ZEC consolidating within a bullish flag pattern after reaching a four-year high.

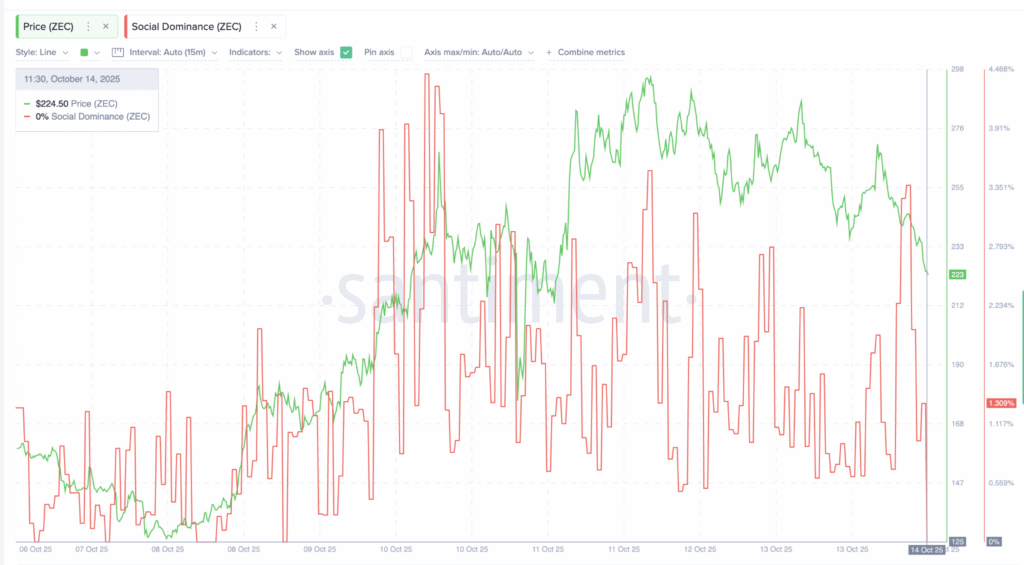

Meanwhile, Santiment data show that social dominance for Zcash dropped sharply after October 10, when the coin reached its peak. The decrease in mentions coincided with the price correction, but the pattern mirrors earlier movements in October, when a similar dip preceded a breakout rally.

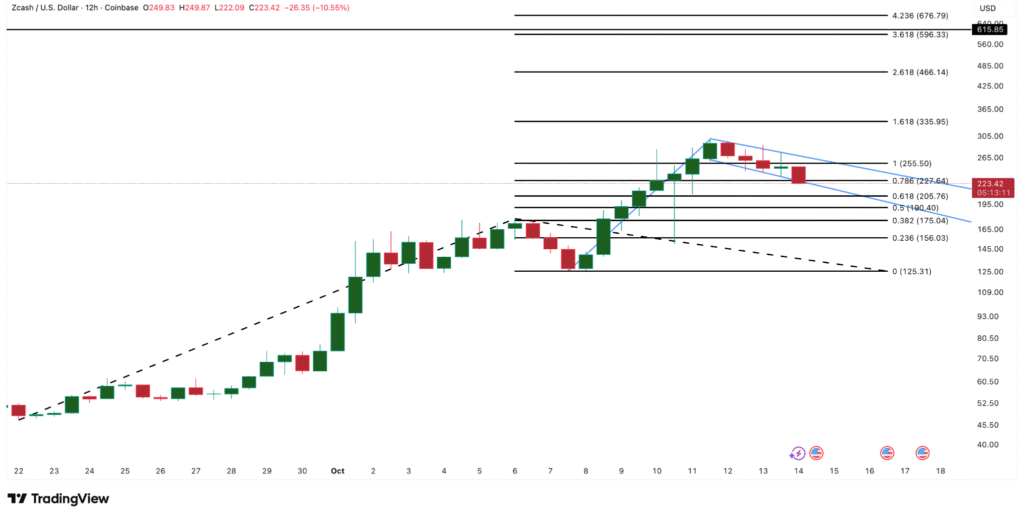

Bull Flag Pattern Points to Potential Upside

Technical charts indicate that ZEC’s structure remains within a bull flag formation. According to TradingView data, a sustained move above the $255 mark could confirm another breakout. If this happens, ZEC may aim for Fibonacci extension levels at $335 and $466, with a longer-term projection near $615.

The RSI remains neutral, suggesting that there is room for growth before overbought levels are reached. The MACD lines have also flashed a buy signal following the correction, reinforcing the bullish setup. Analysts say that a close above $255 could strengthen bullish conviction, while a drop below $190 may weaken momentum.

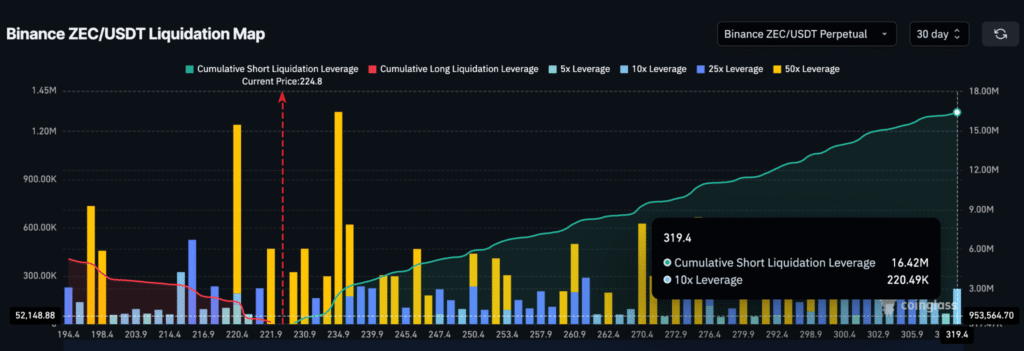

Short Interest Builds as Traders Anticipate a Squeeze

Derivatives data from Coinglass show that short positions are accumulating rapidly. More than $16.4 million in short leverage has been placed below the current price, compared to $5.2 million in long positions. This heavy short bias increases the chances of a potential short squeeze if ZEC moves above $255.

At press time, ZEC trades around $263, consolidating within its flag structure. Analysts believe that quiet social sentiment, rising short exposure, and intact technical patterns may set the stage for another upward move in the coming sessions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.