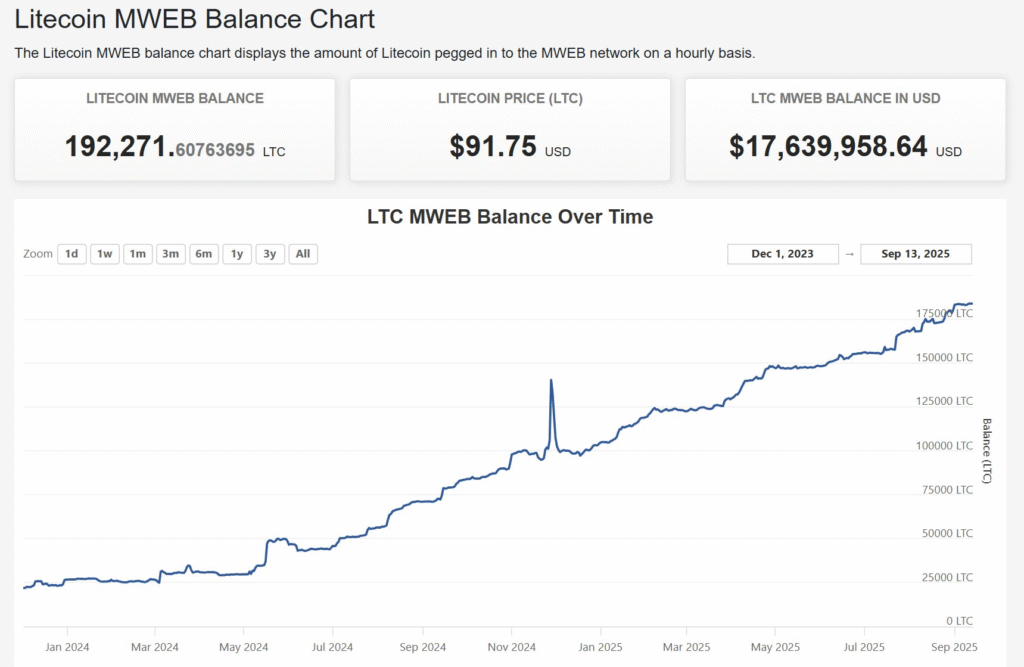

- Litecoin’s MWEB balance reaches 192,271 LTC, highlighting growing interest in privacy solutions.

- The weekly chart structure suggests Litecoin could be mirroring the 2020 cycle, with a rally potentially in 2026.

- A strong recovery in Litecoin’s price is seen, with traders awaiting confirmation of bullish momentum.

Litecoin’s Recovery Path and Key Indicators

Litecoin (LTC) is showing signs of potential recovery after experiencing a significant decline. Recent data shared by cryptocurrency analyst Master Kenobi suggests that Litecoin’s price structure is now exhibiting a similar pattern to its pre-bull market phase in 2020.

The analyst pointed out that the 190-day structure on Litecoin’s weekly chart mirrors the setup observed before the 2020 rally, indicating that Litecoin may be in a favorable accumulation zone. With this structure, Litecoin is potentially positioning itself for another major market cycle.

Kenobi emphasized that 2025 could be seen as a reflection of 2020 rather than 2021, suggesting a major rally might occur around 2026. This aligns with the broader belief in cyclical market behavior in cryptocurrencies. Litecoin’s current market capitalization stands at about $6.7 billion, and its price continues to attract attention from both traders and investors.

MWEB Balance Nears 200K Mark

Meanwhile, Litecoin is experiencing steady growth in its MWEB (MimbleWimble Extension Block) balance. The Litecoin MWEB network, which facilitates privacy-enhanced transactions, has seen significant growth, with the balance nearing 200,000 LTC.

Currently, the MWEB balance stands at 192,271.61 LTC, which is worth approximately $17.64 million at a price of $91.75 per coin.

The data from the Litecoin MWEB Balance Chart, covering the period from December 2023 to September 2025, suggests increasing adoption of the privacy feature. Litecoin has shown optimism about surpassing the 200,000 LTC milestone, highlighting rising confidence in blockchain privacy solutions.

As Litecoin nears this milestone, it also demonstrates the increasing relevance of privacy-focused blockchain solutions in the cryptocurrency space. The steady increase in adoption further solidifies Litecoin’s position as a key player in the privacy sector.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.