- Pumpfun trades 59.20% below its $0.008819 all-time high.

- The token faces pressure near the $0.003134 S1 support level.

- RSI hovers at 32 while MACD shows continued bearish momentum.

Pumpfun (PUMP) continues to face market pressure as its price moves closer to a crucial support level. The token fell 2% on Friday, marking its fourth consecutive day in the red. This follows a 9.50% drop in the previous session. The market shows limited buying momentum as traders respond cautiously to the recent trend.

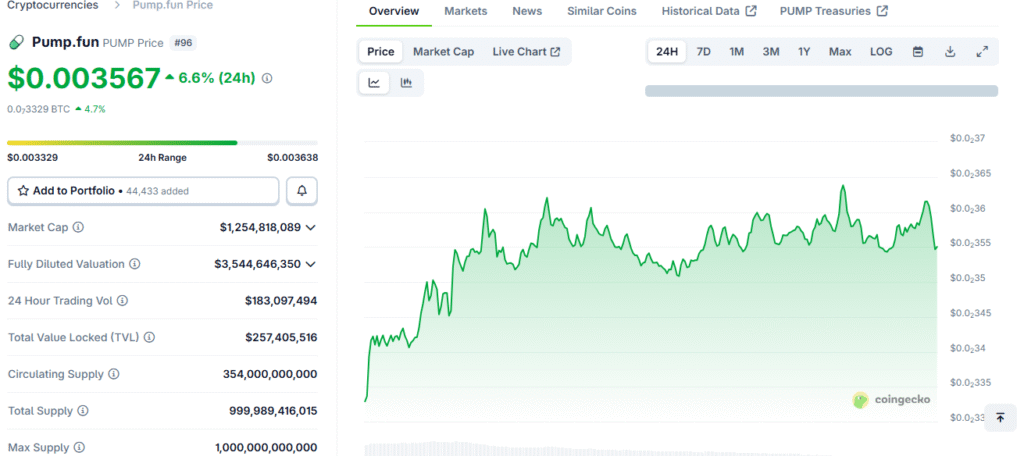

At press time, Pumpfun is trading at $0.003567, down from its all-time high of $0.008819 and up from a low of $0.002283. The token is now 59.20% below its peak and 57.61% above its lowest point, showing its current position within a wide trading range.

Technical Indicators Signal Continued Weakness

The daily chart reveals that the token’s downtrend is nearing the S1 Pivot Point support at $0.003134. If this level fails to hold, the decline could extend to Friday’s low of $0.001496. Analysts observe that trading volumes remain moderate, suggesting limited new inflows.

The MACD and its signal line have both crossed below the zero mark, indicating a shift toward bearish momentum. The Relative Strength Index (RSI) stands at 32, just above the oversold zone, signaling strong selling pressure but potential for near-term stabilization.

Potential Rebound Scenarios and Market Outlook

If Pumpfun manages to defend the $0.003134 level, a rebound could take shape toward the $0.005000 psychological mark. This recovery zone could attract short-term buyers seeking to benefit from discounted prices.

Market data from CoinGecko shows a 24-hour trading volume of $183 million, while the market cap stands at $1.25 billion. Despite the recent correction, the project retains over $257 million in total value locked (TVL), suggesting that user participation remains active.

As traders await confirmation of a rebound or further breakdown, Pumpfun’s next move depends on how it reacts around its immediate support level in the coming sessions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.