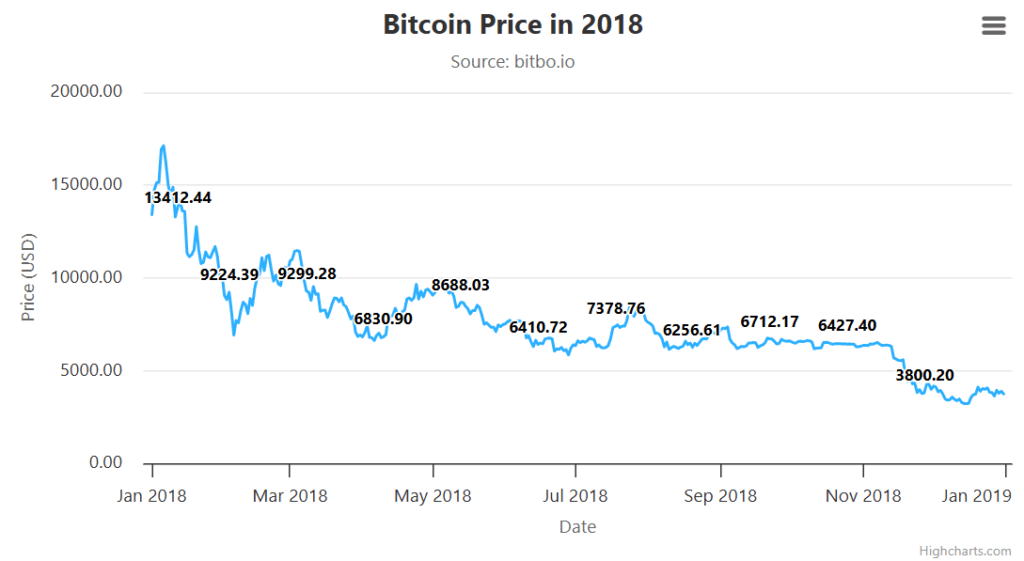

- Bitcoin saw a 72% drop during Trump’s policies in 2018.

- Institutional support and ETFs could push Bitcoin’s price to new highs.

- Macroeconomic factors and regulatory risks could impact Bitcoin’s future trajectory.

Bitcoin has tumbled under mounting pressure as former President Donald Trump’s aggressive tariffs on key trading partners trigger market uncertainty. In just a week, Bitcoin’s market value plunged by 8.29%, wiping out trillions. Investors are now shifting towards traditional safe-haven assets, with gold hitting an all-time high above $2,880 per ounce.

Meanwhile, the U.S. dollar index soared past 109, driven by higher import costs from China, Mexico, and Canada. With inflation concerns rising, many wonder if Bitcoin can withstand the storm or if traditional finance will reclaim its dominance.

Bitcoin Struggles Amid Tariff Tensions

The U.S.-China trade war has resurfaced with full force, fueling economic uncertainty. The newly imposed 10% tariff on Chinese imports has intensified inflationary concerns, making investors cautious. Consequently, the Federal Reserve remains hesitant to cut interest rates, further pressuring risk assets like Bitcoin.

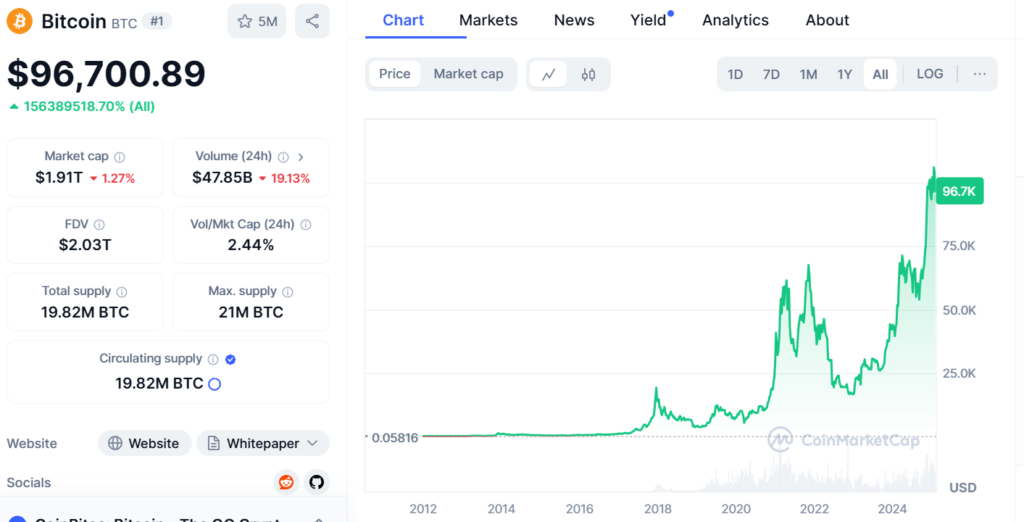

Despite this, Bitcoin’s role as a store of value has evolved over the years. Unlike in 2018 when Trump’s trade war triggered a 72% Bitcoin decline today’s market is more resilient. Institutional investment has grown significantly, softening the blow of macroeconomic shifts.

Traders are now closely watching the upcoming Consumer Price Index (CPI) report. If inflation climbs, Bitcoin could slip further, potentially testing the $90,000 mark. A surprise decline, however, may provide relief, allowing Bitcoin to recover its lost ground.

Trump’s Bitcoin ETFs Spark Market Volatility

Amid economic uncertainty, Trump Media Group made history by announcing the launch of multiple Bitcoin ETFs. This marks the first time a U.S. president has been directly associated with a cryptocurrency ETF. The news sent shockwaves through the market, causing Bitcoin to surge from $45,000 to $48,500 within an hour.

Trading volumes exploded, with major exchanges like Coinbase and Binance recording a peak volume of 25,000 BTC quickly. This move indicates growing institutional confidence, even as market volatility remains high.

As 2025 unfolds, Bitcoin faces a defining moment. If it weathers the tariff storm and benefits from ETF-driven adoption, its position as a safe-haven asset may finally solidify. However, further downward pressure could be inevitable if inflation worsens and interest rates remain elevated.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.