- SHIB price faces resistance near $0.00001050, signaling weak bullish momentum.

- Shibarium’s TVL has dropped significantly, indicating muted DeFi adoption.

- SHIB’s long-term outlook remains uncertain, with minimal DEX activity.

Shiba Inu ($SHIB) has recently shown a slight upward movement, with the price increasing by 0.60% to reach $0.00001013. However, its price action is far from showing a full recovery.

Despite this modest rise, $SHIB still faces numerous challenges, primarily due to ongoing struggles with the adoption of Shibarium. A sharp increase in SHIB price followed a period of low volume, but traders remain cautious, noting the overall lack of momentum.

Shibarium’s Declining TVL

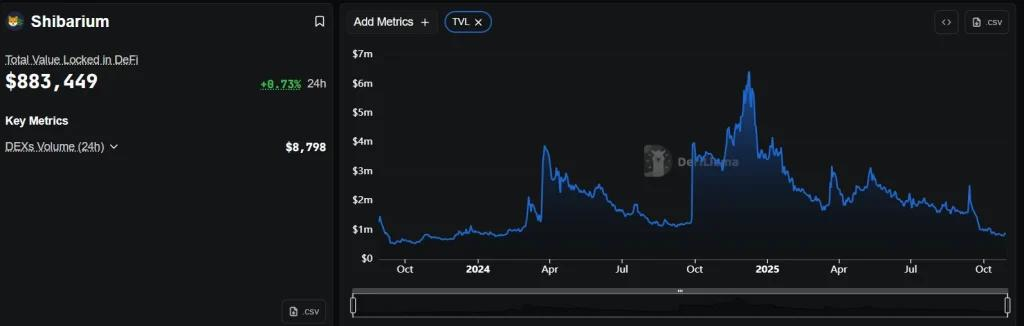

The Shiba Inu ecosystem’s layer-2 solution, Shibarium, has seen a dramatic decline in its Total Value Locked (TVL). According to DeFillama, Shibarium’s TVL stands at just $883,449, a significant drop from its February high of over $6 million.

This decline signals challenges in DeFi adoption on Shibarium, raising questions about the long-term utility of SHIB. The falling TVL reflects broader concerns about the lack of traction for Shibarium within the decentralized finance (DeFi) space.

The low TVL has led some analysts to question whether Shiba Inu can rely on Shibarium as a key driver of future growth. As DeFi adoption on Shibarium remains muted, SHIB’s broader utility narrative is under scrutiny.

With minimal decentralized exchange (DEX) activity only $8,798 in 24-hour volume SHIB’s long-term outlook remains uncertain.

Technical Analysis and Price Struggles

On the technical side, SHIB is struggling to break past key resistance levels. The coin’s price currently stands at $0.00001018, representing a 1.14% decline over the last 24 hours.

A 24-hour trading volume of $151 million is down by 2.89%, signaling weakening trader enthusiasm. SHIB briefly bounced off a low of $0.00001002, but failed to clear resistance near $0.00001041.

More importantly, SHIB recently broke below its 7-day Simple Moving Average (SMA), indicating sustained bearish pressure. The MACD (Moving Average Convergence Divergence) shows weak bullish momentum, while the Relative Strength Index (RSI) hovers at 41, suggesting room for further downside.

Additionally, traders are actively defending the $0.0000095 support level, which is critical in preventing further losses. Despite these efforts, SHIB has struggled to recover above its 200-day SMA, which remains a crucial resistance point at $0.000012712.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.