- CZ owns less than 1% of BNB total supply showing decentralization trend.

- 64M BNB permanently burned equal to 31.8% of historical token supply.

- $921M inflows into crypto funds mark renewed market participation momentum.

BNB continues to defend its key $1,000 support zone amid cautious sentiment, as new data from YZi Labs reveals a detailed view of its ownership structure and ongoing supply reduction mechanisms. The asset remains under close market observation following a 4% dip, while inflows of $921 million into crypto funds signal a renewed rise in investor activity.

BNB Ownership Distribution Reflects Broad Public Control

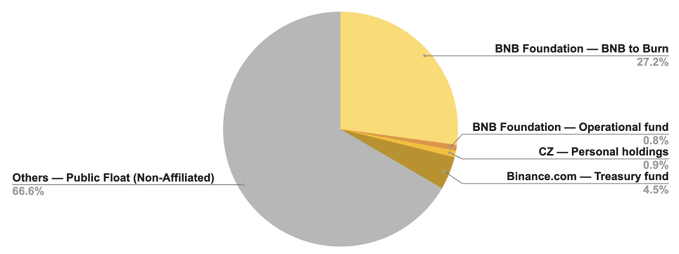

YZi Labs confirmed that BNB’s total supply remains capped at 100 million tokens, with ownership showing wide distribution. The report shows that about 66–67% of the total supply is held by unaffiliated public investors through exchanges or self-custody wallets.

Binance founder Changpeng Zhao holds less than 1% of all BNB, which the report said points to “a decentralized structure compared to other major assets.” The BNB Foundation controls around 27% of supply for strategic network activities, including programmatic burns.

Binance’s treasury retains about 4–5% of tokens, used for operational liquidity and internal system functions. This structure ensures a broad balance between public ownership and foundation control, aligning with long-term token management plans.

Supply Reduction Continues Through Burn Mechanisms

BNB’s deflationary design continues to play a role in supply management through Auto-Burn and BEP-95 systems. Together, these processes have removed more than 64 million tokens from circulation, equating to nearly 31.8% of historical supply.

The Auto-Burn adjusts the burn rate based on market activity, while BEP-95 eliminates a portion of transaction fees in real time. The BNB Foundation manages transparency for these mechanisms, releasing data following every quarterly burn.

Market Stability Amid Price Consolidation

Despite a recent 4% decline, BNB remains above the $1,000 zone. Chart data shows that a drop below $1,026 could trigger further losses, though reclaiming the $1,150 resistance may restart an upward move.

Recent price action indicates consolidation within a narrow range. Meanwhile, YZi Labs data shows $921 million flowing into digital asset funds, suggesting improving market sentiment as traders anticipate a steadier phase for major cryptocurrencies.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.