- Bitcoin has dropped by over 3.5% in the past 24 hours and briefly fell below $104,000.

- A Head and Shoulders pattern suggests a further drop toward $90,000.

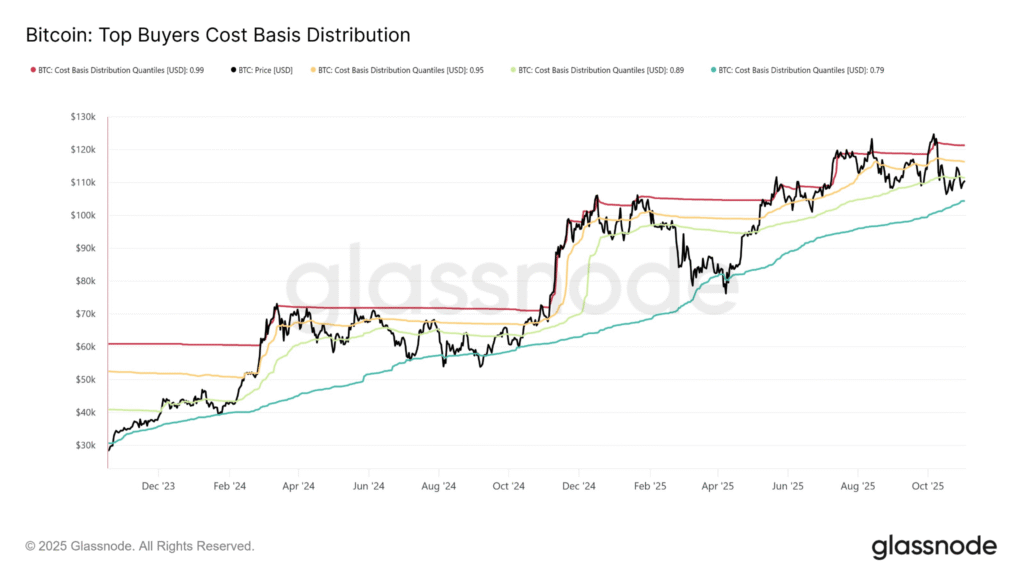

- Glassnode data shows that BTC has failed to reclaim the top buyers’ cost basis since July.

Bitcoin (BTC) is facing strong selling pressure as its price continues to fall, testing crucial support levels. On Tuesday, BTC fell to $103,732 before rebounding slightly above $104,000.

This marks a 1.95% decline on the day and a decline of over 3.5% in the past 24 hours. Crypto analyst Mikybull Crypto shared a chart on TradingView indicating a potential short-term drop to $100,000.

The analysis indicated a dotted path, suggesting a potential rebound toward $130,000–$140,000 if the support level holds. The blue moving average on the weekly chart shows the potential level of support around $100,000.

On-Chain Metrics and Glassnode’s Observations

On-chain data platform Glassnode added further insight into Bitcoin’s declining momentum. The platform posted on X that since July, Bitcoin has failed to recover the cost basis of top buyers. It utilized the “Top Buyers Cost Basis Distribution” metric to display the average entry prices of recent high-priced buyers.

The metric includes key quantiles such as the 0.99 (red), 0.95 (yellow), 0.89 (green), and 0.79 (mint) lines. Each line represents the average cost of top buyers, with the green line currently at around $111,000. Glassnode noted that this level, previously support, has now turned into resistance.

Following Bitcoin’s failure to stay above $111,000 after a minor surge to $110,800, Glassnode said, “This increases the odds of a retest of the 0.8-quantile cost basis ($104K) as top buyers capitulate.”

Bearish Patterns and Market Warnings

Analysts also pointed out chart patterns that may support further downside. Crypto expert Toby Dawson confirmed a Head and Shoulders formation. The pattern includes a left shoulder near $117,000, a head at $126,000, and a right shoulder around $117,000.

This traditional reversal pattern suggests a trend change, and Dawson warned that BTC could fall below $100,000. Meanwhile, investor Ted Pillows highlighted a CME futures gap at around $92,000. “If Bitcoin drops below $100,000, expect a correction toward $92,000,” he said.

As the price sits near a psychological and technical level, the market may face more volatility in the short term.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.