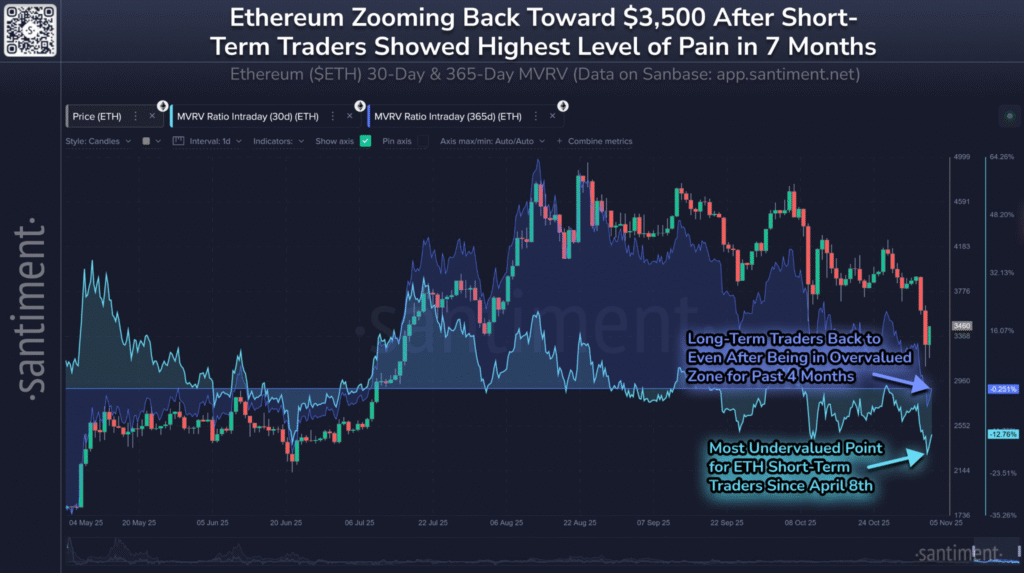

- Ethereum’s MVRV ratio shows short-term traders at -12.8%, signaling market pain.

- Ethereum’s price recovery offers low-risk buying opportunity for traders.

- Both short and long-term MVRV ratios are negative, indicating undervalued market conditions.

Ethereum has bounced back toward the $3,500 mark after briefly testing the $3,000 support level just a day ago. The cryptocurrency’s price movement has drawn attention from market analysts as it shows the highest level of trader pain in seven months.

Ethereum’s short-term traders, active within the past 30 days, have seen an average return of -12.8%, indicating a significant level of market discomfort. This pain suggests there is still potential for the price to rise until it returns to the 0% return threshold.

Short-Term and Long-Term MVRV Ratios Show Undervaluation

The MVRV (Market Value to Realized Value) ratio for Ethereum, calculated over the last 30 days, reveals that the market is experiencing a high level of pain, as traders remain in the negative range.

The negative MVRV ratio for short-term traders implies that these traders are currently at a loss, despite Ethereum’s recovery. This underperformance of short-term traders signals an opportunity for market participants looking to enter the market at a relatively lower risk.

From a longer-term perspective, Ethereum’s 365-day MVRV ratio also shows that traders active in the past year are now back in negative territory at -0.3%. This indicates that Ethereum is currently undervalued from a long-term investor’s viewpoint.

Historically, when both the short-term and long-term MVRV ratios sit in the negative zone, it has proven to be a favorable buying opportunity.

Ethereum’s Recovery Points to a Low-Risk Entry

The ongoing price recovery of Ethereum highlights a shift from a potentially overvalued market to a more favorable condition for buyers. Ethereum’s price climbed back toward the $3,500 mark, recovering after its brief drop below $3,000.

While the MVRV ratio for short-term traders indicates pain, it also highlights that Ethereum may offer a low-risk entry point for investors. The negative MVRV readings for both short and long-term traders further underscore the possibility of continued upward movement as market conditions normalize.

The current price action in Ethereum offers an opportunity for investors to buy at lower prices, with the potential for higher returns once the market returns to a more balanced state.

This recovery, coupled with the historical significance of negative MVRV ratios, suggests that Ethereum could offer an advantageous opportunity for strategic investors during market fluctuations.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.