- VeChain ($VET) shows a bullish reversal with TD Sequential buy signals.

- $VET approaches key support levels, signaling a possible upward movement.

- RSI at 61.02, indicating balanced market conditions for VeChain’s short-term momentum.

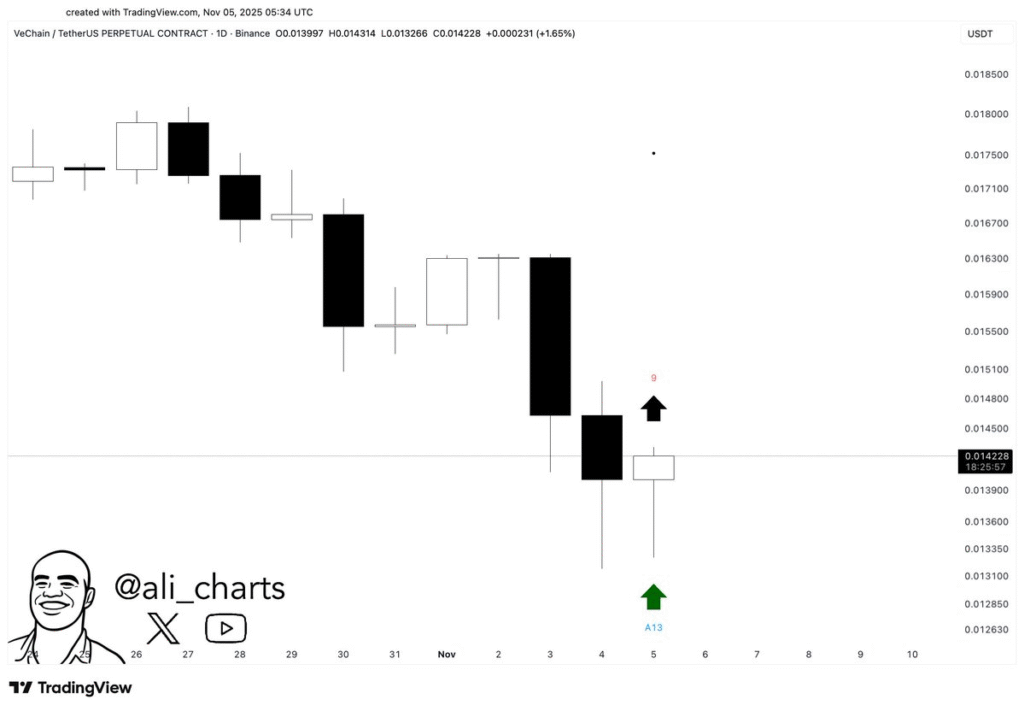

VeChain ($VET) recorded promising technical indicators, sparking interest from traders. The TD Sequential indicator, often used to spot potential reversals, triggered two key buy signals: a red 9 and a more aggressive 13. These signals are commonly interpreted as signs of a potential bullish reversal, suggesting the price may trend upward after recent declines.

TD Sequential Buy Signals

According to Ali Martinez, who shared this analysis, the 9 and 13 signals are commonly associated with the start of a bullish reversal. The green arrow on the chart marks the 13 signal, while the black arrow points to the red 9. The price, hovering near $0.0132, could see upward movement if these signals hold.

These types of signals often prompt traders to monitor the market closely for confirmation. Since the $VET market can be volatile, watching for price action at these levels will help traders assess if a rally is likely. If confirmed, it may represent an opportunity to enter long positions.

Price Action and RSI Insights

VeChain’s price saw slight correction but soon regained lost ground. As per a 30-minute chart, the price surged above key moving averages, including the 20-period EMA.

This action indicated a short-term bullish momentum. The Relative Strength Index (RSI) registered 61.02, meaning the asset was not in overbought or oversold territory.

The volume spike seen during this period further signaled increasing market interest. Traders are watching as $VET approaches resistance at $0.01494. The asset’s relative strength, alongside the upward price movement, suggests that $VET may be preparing for further gains.

Support Levels and Market Sentiment

In addition to the TD Sequential signals, a strong bullish reversal pattern formed with a daily engulfing candle. Brain2jene pointed out that the cryptocurrency erased the previous day’s losses and formed a solid base near a critical support level, represented by a purple box on the chart.

This setup signals a possible bounce and shows potential for upward momentum. Resistance lines indicate that future price action will depend on whether $VET can surpass these levels. Traders will likely remain cautious, waiting for more signs of sustained upward movement.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.