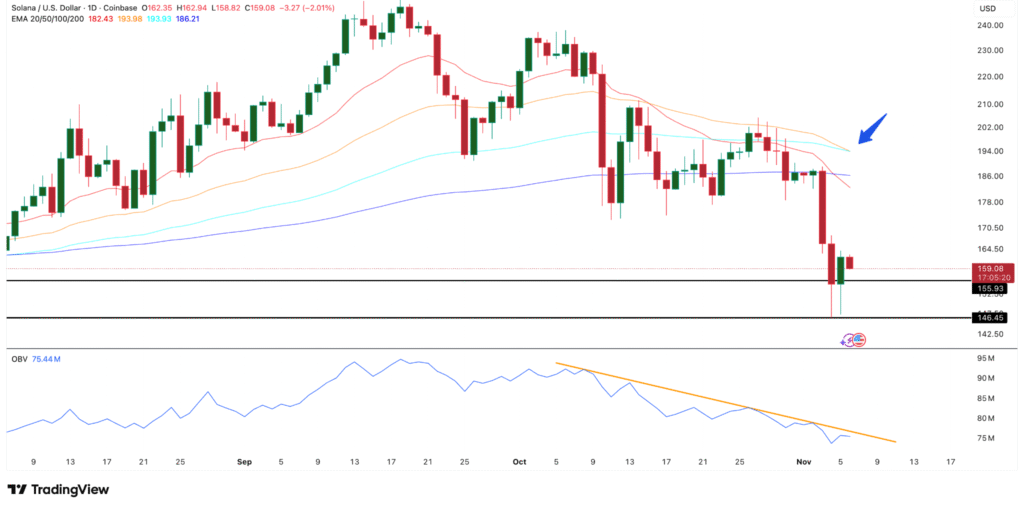

- Solana’s OBV remains trapped under a descending trendline, signaling ongoing selling pressure.

- Solana price faces a critical test at $155.60, with further breakdown possible towards $146.

- Increased exchange inflows suggest renewed selling pressure, keeping the market tilted towards the bears.

Solana ($SOL) is currently experiencing mounting selling pressure as it struggles to hold a critical support level at $155.60. The latest data shows Solana trading at $156.35, marking a 1.85% drop.

Crypto Tony, in his recent update, emphasized the importance of this level for the bulls. A failure to hold the support could lead to further declines, potentially breaking below $150.

Bearish Setup Confirmed by Technical Indicators

Solana’s price chart shows a clear shift in momentum as bearish indicators continue to strengthen. The 50-day Exponential Moving Average (EMA) is now approaching a crossover under the 100-day EMA. This technical pattern typically signals a loss of control by the bulls, as downward pressure increases.

Adding to this bearish signal is the On-Balance Volume (OBV), which remains trapped under a descending trendline. This suggests that buying volume is not supporting price rebounds, and each attempt has been met with renewed selling.

Meanwhile, Glassnode net exchange flows saw a notable shift, with -293,015 SOL leaving exchanges, indicating outflows. However, by November 5, the metric flipped to 17,649 SOL flowing back into exchanges, signaling a 106% shift towards inflows.

This change points to growing selling pressure, with traders and retail investors offloading tokens. Until exchange flows revert to sustained outflows and OBV breaks its trendline, the balance remains tilted toward the bears.

Key Price Levels to Watch

Solana is currently hovering around the $156 mark, with support near the 0.236 Fibonacci retracement level between the October 27 and November 4 swing. If the price fails to hold above $146, the next major support lies at $126, marking a deeper potential drop.

For a recovery to take place, Solana needs a breakout in OBV and a reversal in exchange flows. Should the bulls manage to restore technical balance, the first key resistance level is at $168. A break above this level could open the door to further resistance at $182 and $192.

Until these conditions are met, Solana remains weakened, with any rebound attempts facing significant resistance from the bears.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.