- BCH is testing crucial support at $470, with a potential bounce if the level holds.

- Technical analysis shows BCH may follow ZEC’s recent bullish trend after breaking key price levels.

- BCH faces resistance at $500, with significant volume signaling market interest around key price zones.

Bitcoin Cash ($BCH) is currently testing a critical support level near $470. The price has recently shown a decline, and this support zone has become a focal point for traders.

The 50-day moving average, shown by the blue line in the chart, also plays a role in determining the price’s movement in the near future. If the $470 support level holds, BCH could potentially experience a price bounce.

As the price approaches $470, market participants are closely monitoring whether this support will act as a floor for BCH. If it does, the cryptocurrency could experience upward movement.

BCH’s Bullish Technical Indicators Point Toward Potential Rally

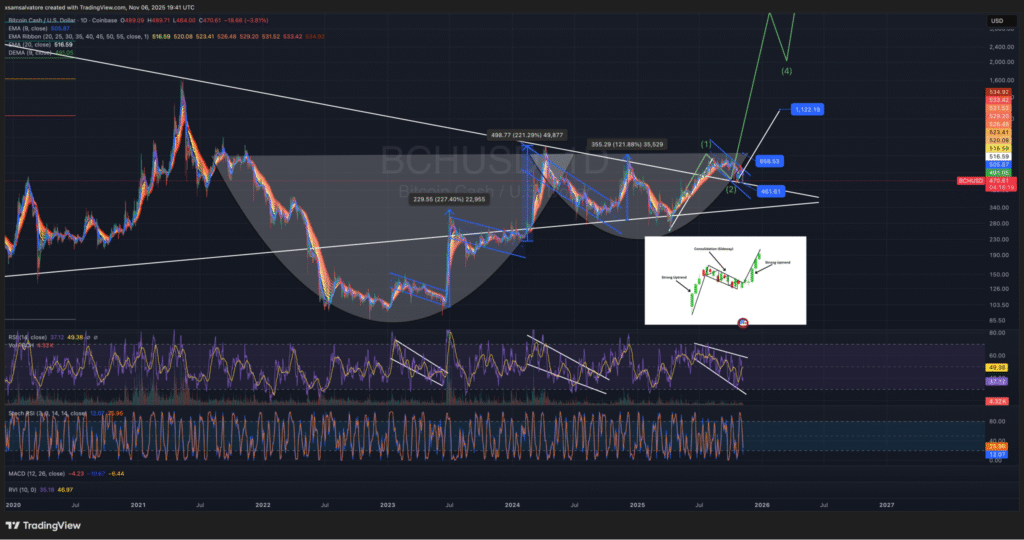

Bitcoin Cash ($BCH) is also showing promising technical patterns, according to recent analysis by SⱯMX. The chart features four distinct bull flags on the 1D chart, each indicating a potential breakout.

These flags have historically broken out at key inflection points, such as the July 2023 cup bottom (+227%), February 2024 cup bottom (+221%), and the November 2024 wedge support (+121%). The current pattern, which features the RSI in a descending channel/wedge, suggests that BCH could be primed for a potential breakout.

Resistance at $500 and Key Support at $470

Bitcoin Cash is facing significant resistance at the $500 level, according to analysis from CW. The sell wall around $500 is a critical price zone that BCH has been struggling to break through.

In contrast, the $470 support level has become a key point for traders to watch. Recent price action suggests BCH is testing this support zone, and its ability to hold at this level will be crucial for determining whether the cryptocurrency can continue its upward movement.

The resistance at $500 is a clear barrier to any further price increases, with BCH testing this level multiple times in recent weeks. If BCH fails to break this resistance, it could face a pullback, with the $470 support acting as a key line of defense.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.